As readers are now aware, reading the cash flow statement is critical in understanding the cash-generating ability of a company. Since we know the broad structure of the cash flow statement, it is time to dive into each of its individual components. Out of the three sub-components of the cash flow statement - cash flow from operations, cash flow from investing, cash flow from financing, let's focus on the first.

Meaning of cash flow from operations

The cash flow from operations (CFO), as the name suggests, records the quantum of cash inflows and outflows that can be attributed to the regular business activities of a company. In other words, this statement gives investors information about the amount of cash generated (or lost) from its core business, i.e., selling goods/services to customers.

Some examples of transactions involving cash flows from operating activities are:

1. Cash receipts from the sale of goods and services

2. Cash payments to suppliers of goods and services

3. Cash payments to and on behalf of employees

Since the cash flow from operations restricts itself to operating activities, it would not, for most companies, record any cash flows arising out of ancillary activities such as receiving interest from a fixed deposit (FD), distributing dividends to shareholders, etc.

How is cash flow from operations prepared?

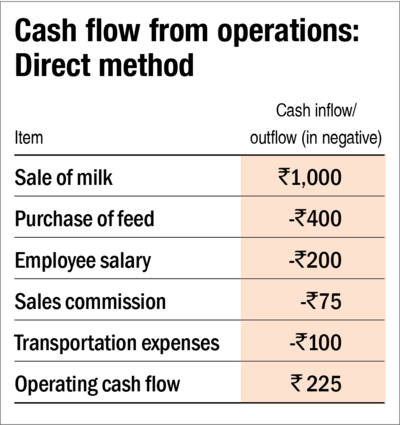

The cash flow from operations can be prepared in two ways: the Direct method and the Indirect method. The direct method, arguably the more intuitive way of recording cash flows, simply lists all inflows and outflows that have occurred in a company's operations. A simplistic illustration of the cash flow from operations of a hypothetical company, which sells milk, created using the direct method would be as given:

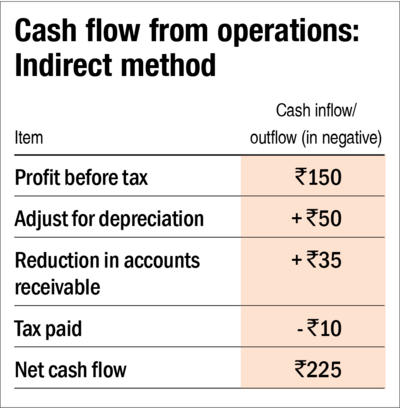

The indirect method, on the other hand, works very differently. It is based on the idea that entries in the Profit & loss statement and the Balance sheet can be segregated into cash-based and non-cash-based items. Since we are trying to estimate the effect of only cash-based entries, this can be achieved by simply eliminating the non-cash-based items.

Therefore, the indirect method begins with the profit before tax reported in the profit & loss statement and then reconciles the same by adjusting for the non-cash items. There are two sets of adjustments: One regarding the profit & loss items and the other with respect to the balance sheet items. First, non-operating and non-cash incomes which are included in the profit & loss statement (by virtue of its accrual nature), are removed. The next set of adjustments is carried out by eliminating the impact of balance sheet-related changes in working capital (current assets and current liabilities) to determine the cash flows before tax, after which the amount of tax paid is subtracted to get the cash flow from operations.

Using the same hypothetical company from the above example, the indirect method would be as given:

While the direct method provides information on the specific sources of operating cash receipts and payments, the indirect method shows the reason for the difference between profits and operating cash flows. In the Indian context, though there isn't any mandate on which method companies must use, they are encouraged to report cash flow from operating activities using the direct method as it provides more useful information in estimating future cash flows. However, the indirect method is the preferred choice for companies.

Other things to keep in mind

Though receiving interest from a fixed deposit wouldn't generally be captured in the cash flow from operations, there is an exception when it comes to finance companies (Banks, NBFCs, etc). Since the primary business of such companies involves lending money (unlike other companies where lending money is an ancillary activity), such activities are included in the cash flow from operations.

One disadvantage of the cash flow from operations is that it doesn't tell the period pertaining to which the cash is supposed to have been received. For example, if cash was received on January 5, 2022, it would be impossible for readers to know the period in which the sale, for which cash has come, was made. The actual transfer of goods/rendering of services could have happened anytime before the date of receipt of cash or after (if customers pay in advance).

While a positive cash flow from operations is generally a good sign, it is also important for investors to understand that a negative cash flow from operations is not necessarily a bad sign. If the cash flow from operations of a company turns negative due to reasons such as a sudden build-up in inventory to cater to higher anticipated demand or an increase in working capital due to an expansion of the business, investors need not be as worried as compared to companies that consistently post negative cash flows.

Conclusion

Since the amount of cash flows from operating activities is a key indicator of the extent to which the operations of a company have generated sufficient cash flows, reading the cash flow from operations is vital in gauging the company's long-term success. Information about the specific components of historical operating cash flows, when used together with other financial information, can be useful in forecasting future operating cash flows. Moreover, when used together with the profit & loss statement, operating cash flows can give you a clear picture of the real profitability of the company. Investors must ensure that they look carefully at the cash flow statements before making any investment decisions.

The cash flow statement of every company is available at the website of Value Research. First, search for the company in the search bar. You will be directed to the the company's stock page and will land at the 'Snapshot' tab. Go to the 'Financials' tab. Here you will find the annual financials of the company. The cash flow statement is located after the income statement and the balance sheet.

Also in the series: