One of the most frequently asked questions that we encounter is 'Is this the right time to invest in the stock market?' The answer to this question needs a degree of clarity of thought around which type of stocks should be timed and for which type of stocks, this question is irrelevant.

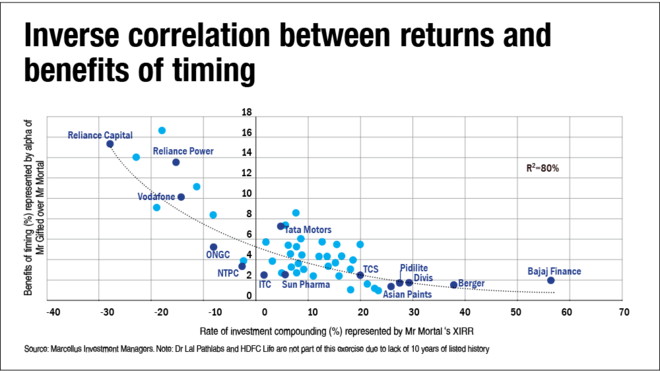

The chart 'Inverse correlation between returns and benefits of timing' shows an inverse correlation between the rate of compounding of share prices with the quantum of benefit derived from a perfectly timed purchase of these equities on an ongoing basis. This analysis has been carried out on a combination of Nifty 50 constituent stocks (as they stood in 2008) and the current Marcellus' CCP (Consistent Compounders Portfolio) portfolio constituents (some of which were also part of Nifty 50 in 2008).

For every stock analysed in this chart, we have taken 11 sets of 10-year periods of investment starting with April 1, 2000. For example, for L&T, the first 10-year period starts on April 1, 2000, and ends on March 31, 2010. The second set starts on April 1, 2001 and ends on March 31, 2011. The 11th set starts on April 1, 2011 and ends on March 31, 2021. In each of these 11 sets, 'Mr Mortal' and 'Mr Gifted' receive Rs 1 crore of cash inflow into their bank accounts. Mr Mortal invests Rs 1 crore annually on 1st April of each financial year, whilst Mr Gifted invests Rs 1 crore annually at the 52-week low price of each financial year. XIRRs are then computed for all the sets of 10-year periods are then averaged to get Mr Gifted's and Mr Mortal's average XIRR comparison for each stock.

Effectively, the scatter chart is suggesting that:

- For companies whose share price compounds at a high rate of more than 15-20 per cent CAGR (represented by Mr Mortal's investment performance), even perfect timing of entry points (i.e., investing every single year at the year's lowest share price) does not generate more than 2-3 per cent alpha (represented by Mr Gifted's outperformance over Mr Mortal).

- For companies whose share price compounds at a weak rate (say less than 10 per cent CAGR), perfect timing of entry points can generate 5-10 per cent alpha compared to a lack of any timing.

The primary reason for this inverse correlation is that the weaker the fundamentals of a company, the greater the uncertainties from the competition, macroeconomic variables, disruptive evolution, black-swan events, internal factors, etc. These uncertainties then get reflected in the volatility of the respective share prices. Such high levels of volatility in the share prices of companies with weak fundamentals results in a greater alpha for Mr Gifted over Mr Mortal through perfect timing of the entry points (lowest point of every year).

Moreover, the weaker the fundamentals of a company, the weaker will be its long-term rate of share price compounding (since over the long term, rate of growth in fundamentals is the primary driver of growth in share prices), and weaker will be Mr Mortal's rate of compounding (buy and hold, without any ability to time entry points).

A cricketing analogy helps convey this point more clearly. A technically sound batter like Rahul Dravid averages over 50 in Test cricket regardless of whether India is playing at home or abroad, on spinning tracks or on bouncy tracks, in hot conditions or in cold and overcast conditions. Hence, if you are betting on Dravid playing well (and let's define playing well as at least scoring 50 runs), your chances of winning the bet are equally high regardless of where India is playing.

On the other hand, for batters who are less technically sound than Rahul Dravid (i.e., the majority of batters who have played Test cricket for India), their batting average at home will be much higher than their batting average abroad and they will be averaging more on spinning tracks than on bouncy tracks and they will be averaging more if the Test match is played in hot conditions. So, with these sorts of batters, you will be more inclined to bet on them playing well if India is playing at home and in spinning conditions. This is the cricketing equivalent of trying to time your investment in L&T.

High-quality companies: Portfolio rebalancing vs timing

After the reading about the analysis highlighted above, some investors seeking to invest in high-quality companies (like those in the Consistent Compounders Portfolio) might say that 'even though the gap between the XIRRs of Mr Mortal and Mr Gifted is as low as 2-3 per cent for the CCP Portfolio, I want to benefit from this gap and be like Mr Gifted'.

Every stock-market crash causes a dislocation in a portfolio of high-quality companies due to differential drawdowns in the share prices of constituent stocks. Rebalancing such a portfolio in the aftermath of the crash not only generates additional returns but also crushes the risk of being left with uninvested cash. In order to carry out such a rebalancing exercise, the investor should stay fully invested at all times and rebalance her portfolio in two ways to benefit from a stock-market crash. Firstly, after a crash, she should rebalance the portfolio to increase allocation to companies that have undergone high drawdowns in the crash (and finance this investment by shaving off allocations to companies that have not undergone high drawdowns). Secondly, after the share prices of the portfolio companies have recovered, she should again consider rebalancing the portfolio to sell some allocation in companies that have seen a sharper recovery than the rest of the portfolio. Such rebalancing should also be carried out if share-price dislocations happen without a broader stock-market crash.

The quantum of benefit from such rebalancing of portfolios with high-quality stocks is as high as 5-10 per cent per annum, and hence it far outweighs the potential benefits of perfect timing of entry points in such stocks.

There is more to the story. You can read it here.