Like a bank fixed deposit, a company fixed deposit is a deposit with a company, typically a non-banking finance company (NBFC) at a fixed rate of return over a fixed tenure. The rate of interest depends on the maturity of the tenure. Company fixed deposits are governed by Section 58A of the Companies Act.

Features of company deposits

- Eligibility: You must be a resident Indian. NRIs can also invest in them in certain cases.

- Entry age: 18 years or older. Minors can open this deposit, with the natural guardian operating it.

- Investments: Minimum-Rs 1,000. Maximum-No limit.

- Interest: Depends on the tenure of the deposit and the issuer.

- Account-holding categories: (i) Individual (ii) Joint (iii) As specified by the issuer.

- Nomination: Facility is available.

Capital protection

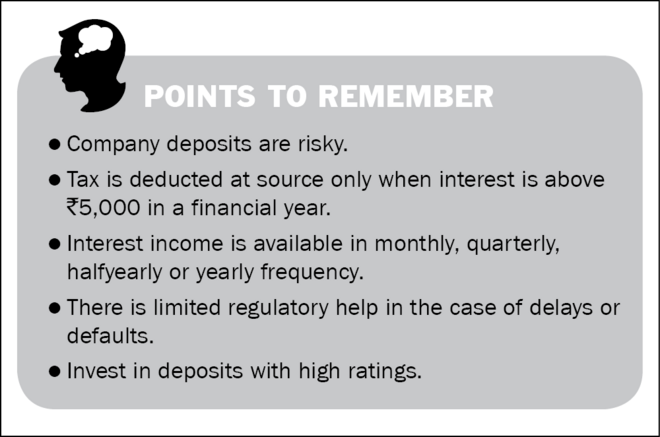

The capital in a company fixed deposit is not protected if the company is unable to meet its financial obligations.

Inflation protection

The company fixed deposit is not inflation-protected. This means that whenever inflation is above the guaranteed interest rate offered by the deposit, the deposit earns no real returns. However, when the interest rate is higher than the inflation rate, the company fixed deposit does manage a positive real rate of return.

Investment objective and risks

The prime objective of investing in a company fixed deposit is to earn a higher interest rate compared to a bank fixed deposit. Company fixed deposits are a good source of regular income, the frequency of which could be monthly, quarterly, half-yearly or yearly.

Suitability and alternatives

- Suitable for moderately conservative investors seeking assured returns from a lump sum investment for goals up to five years away.

- Not suitable for long-term wealth creation, given their inability to provide any meaningful returns above the rate of inflation. Also, not suitable for investors looking to invest small amounts regularly.

- Alternatives can be (i) National Savings Certificate, (ii) Post Office Time Deposits, (iii) Bank fixed deposits, (iv) Debt mutual funds may offer better, though not guaranteed returns.

Guarantees

The interest rate on the company fixed deposit is guaranteed as long as the company can manage to pay the depositors. However, company fixed deposits are known to be delayed and at times, companies default on payments.

Liquidity

Company deposits are liquid to the extent that companies may permit depositors to prematurely terminate their deposits by paying a penalty.

Credit rating

A company fixed deposit has to have a credit rating from a credit-rating agency, such as CRISIL, CARE or ICRA.

Exit option

Premature encashment of the deposit is permissible but the penalties imposed for such encashment are generally higher than those imposed for bank fixed deposits.

Tax implications

The sum invested in a company fixed deposit or the interest that it earns is not eligible for any tax concessions. The interest earned on a deposit on a yearly basis is added to the total income and taxed accordingly.

Going online

Most company fixed deposits are offered offline. At times, they are sold online through a broking account.

Where to make deposits

Deposits can be made directly with the companies offering them or through the distributors selling them.

How to buy

- You need to fill out the deposit application form.

- You may need to submit the original identity proof for verification at the time of buying.

- You can invest in deposits with cash, a cheque, online transfer or a demand draft drawn in favour of the company or the specified entity.

Tips and strategies

- The assured return on a company fixed deposit, like any other deposit, can be used to create an income ladder. Certificates can be bought every month or quarter for appropriate denominations, which on maturity will act as a steady income stream.

- To spread the risk of holding company fixed deposits, make deposits with different companies for different periods.