SBI Mutual Fund has recently launched its SBI Multicap Fund. This is an open-end scheme that will invest across the large-, mid- and small-cap companies.

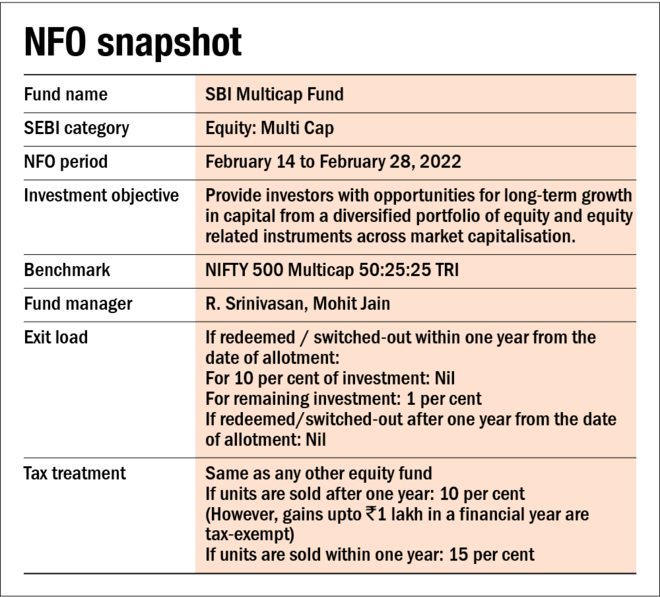

The new fund offer (NFO) is open for subscription since February 14, 2022, and will close on February 28, 2022. The fund will be managed by R. Srinivasan and Mohit Jain. The SBI Multicap Fund is benchmarked against Nifty 500 Multicap 50:25:25 TRI. Here are the key details of the new fund offer:

The multi-cap category has been around for years but these schemes were not true to label as they were predominantly investing in large-cap stocks. Thus, in its circular dated September 11, 2020 for multi-cap schemes, SEBI asked fund houses to invest a minimum 25 per cent in all large-, mid- and small-cap market segments. This did not bode well with the industry participants as it resulted in a massive change in the investment mandate of the existing funds. As a result, the regulator introduced a new category called flexi-cap funds in November 2020 where the AMCs were free to invest across market caps in any proportion. This is exactly what multi-cap schemes were allowed to do earlier. SEBI further permitted fund houses to convert their existing multi-cap scheme into a flexi-cap at their discretion and this option was exercised by a lot of AMCs to retain their existing portfolios.

Since the regulation came into effect, we are seeing many fund companies, including SBI Mutual Fund now, looking to fill the gap in their product line-up in the multi-cap category.

About the strategy

As of January 2022, the multi-cap category has about 14 funds managing assets worth over Rs 43,800 crore. These funds are similar to flexi-cap funds in terms of investing across market caps. However, as the latter doesn't have any restrictions regarding the minimum allocation to any market-cap segment, they enjoy a greater degree of flexibility. Hence, we at Value Research prefer flexi-cap funds over multi-cap ones.

Generally speaking, most flexi-cap funds tend to have a lower allocation to mid- and small-cap stocks than that of multi-cap funds. Owing to this factor, the latter tends to be a bit more aggressive in comparison.

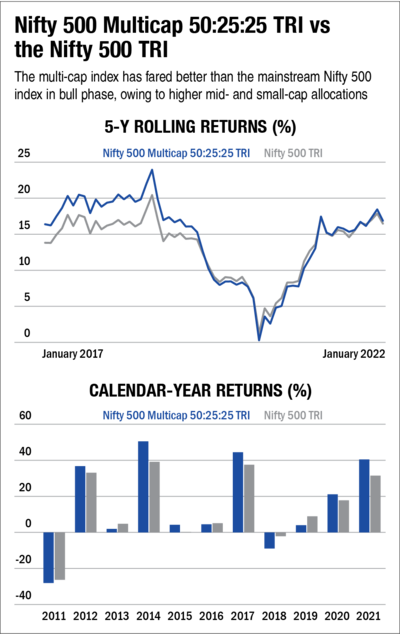

The performance history of multi-cap funds is very short, as the current avatar of the category came into being just about a year ago. But a comparison between the performance of the multi-cap index (Nifty 500 Multicap 50:25:25 TRI) and the more mainstream Nifty 500 TRI reveals that the former was an outperformer on a five-year rolling return basis till about the middle of 2019, thanks to its higher mid- and small-cap allocation. Of late, though, both have been neck and neck. But this performance has also come at the cost of high volatility and bigger drawdowns during the down markets, which again shows the higher mid- and small-cap exposure of the multi-cap strategy.

About the fund manager

SBI Multicap Fund will primarily be managed by R.Srinivasan, while Mohit Jain is the dedicated fund manager for managing overseas investments of SBI Mutual Fund.

R. Srinivasan has experience of more than 28 years in equity markets. Prior to joining SBI, Srinivasan was with Future Capital Holdings, (head of 'Public Markets'), Oppenheimer & Co., Indosuez W. I. Carr Securities and Motilal Oswal Securities among others.

About the AMC

SBI Funds Management Ltd is a joint venture between SBI, India's largest bank, and Amundi (France), one of the world's leading fund management companies. SBI holds 63 per cent stake while Amundi owns 37 per cent of the AMC's equities.

As per the end of January 2022 disclosures, the AMC manages over Rs 6,44,000 crore of investors' money in 142 funds which ranks it 1st in the industry out of 41 fund houses. The fund house currently has 18 actively managed open-end equity schemes with an AUM of over Rs 1,29,00 crore, ranking it 3rd out of 38 in this space.

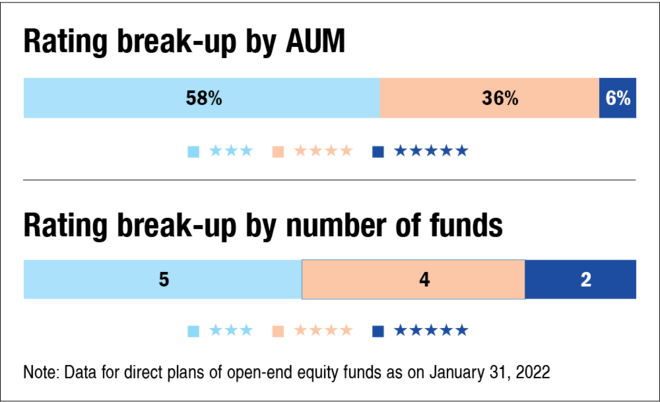

Here is the break-up of the AMC's open-end active equity funds as per Value Research's star rating system, as of January 31, 2022.

Also read: Three questions you should ask before investing in an NFO