Dharmesh, 45, is a seasoned investor. He has been investing in equity funds for the past 20 years and has been able to accomplish several goals with the help of his investments. However, over the years, his portfolio has become cluttered with funds across various themes, sectors, market caps, etc., thereby making it difficult for him to manage it. He now wants to consolidate his portfolio and invest in a few good funds. But when it comes to restructuring a portfolio by selling some of the funds in it, one has to pay tax on capital gains. So, he seeks our help to reduce his capital-gains tax.

How many funds are enough?

At present, Dharmesh is investing in 15 funds, including two tax-saving, two small-cap, three mid-cap, three thematic, three flexi-cap, one value and one large-cap fund(s). Ideally, an investor should not invest in more than four-five funds.

For most investors, investing in two-three flexi-cap funds and one-two tax-saving funds is enough. Also, for proper asset allocation and rebalancing, one should also invest in one-two short-duration debt funds.

Flexi-cap funds invest across the market-cap segments and sectors and therefore provide investors with adequate diversification. Tax-saving funds, or equity-linked savings schemes (ELSS), are also managed in a flexi-cap style. One can invest up to Rs1.5 lakh in these in a financial year and get tax exemption on that amount.

These days many investors also want international diversification, so one can explore adding one-two international funds and investing not more than 25 per cent of your corpus in these. Do note that some flexi-cap funds have also started taking a measured exposure to international equity, so those could be explored as well.

Investing in mid- and small-cap funds is entirely optional and one should do so only if one is willing to take extra risk for extra returns. Also, the exposure to mid and small caps should not be more than 20-25 per cent of the portfolio.

The subscribers of Value Research Premium can refer to the Analysts' Choice section to see the best funds in each of these categories.

How Dharmesh can reduce the number of funds in his portfolio

Dharmesh can do the following to cut the number of funds in his portfolio:

- Find out the funds in his portfolio that have not been performing for several years and exit them.

- Exit sectoral/thematic funds. These funds provide limited diversification. It's your fund manager's responsibility to add the deserving sectors/themes to the portfolio. By taking sectoral/thematic calls, you defeat the purpose of investing in stocks indirectly through equity funds.

- As suggested above, Dharmesh should assess his risk appetite and take a call on his mid/smallcap holdings.

- Large-cap funds are meant for conservative investors. He can consider exiting his large-cap fund. In any case, most flexi-cap funds have a large-cap bias.

- As per the Value Research classification, value funds are also flexi-cap in nature, so he should consider his as part of the flexi-cap bucket and decide on it accordingly.

Reducing the tax liability

Dharmesh should not exit the undesirable funds at one go. Instead, he should make the transition smartly and gradually. Also, he should be aware of the exit load. It is better to wait until a fund becomes exit-load-free.

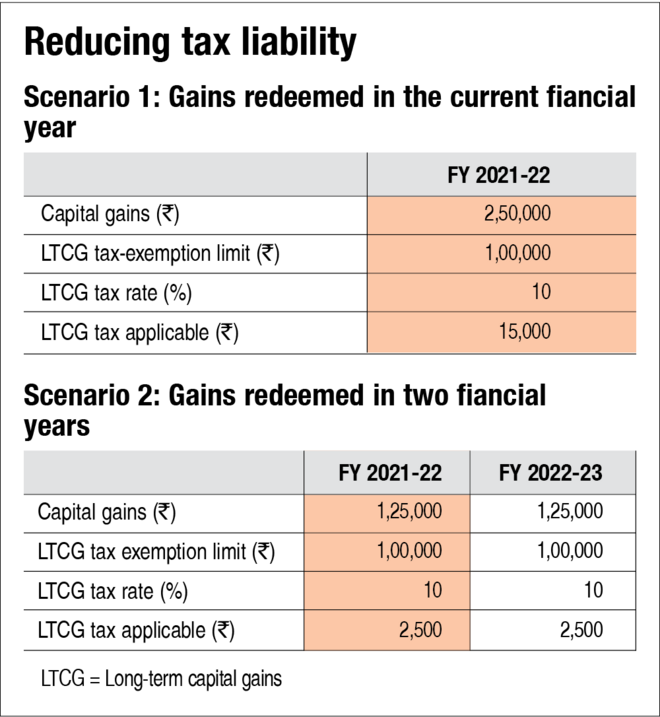

Dharmesh has long-term capital gains of Rs2.5 lakh. As we stand on the cusp of two financial years, there can be no better time to make changes in his equity portfolio. Long-term capital gains on equities up to Rs1 lakh are exempted in a financial year. So, if the gains on his investment are more than Rs1 lakh, he can split these gains between this and the next financial year. A few weeks from now, the new financial year (FY2022-23) would begin, which would automatically refresh his Rs1 lakh exemption limit. This way, Dharmesh will be able to enjoy an exemption limit of up to Rs2 lakh.

If he redeems the desired amount in this financial year (FY 2021-22), he would need to pay a long-term capital-gain tax of Rs15,000. On the other hand, if he breaks his investments between this and the next financial year (assuming that capital gain in each year is Rs1.25 lakh), he would be required to pay a tax of Rs5,000 (see illustration 'Reducing tax liability').

Dos and don'ts of managing a portfolio

Here are some guidelines to manage your portfolio for the best outcome:

- Limit your investments to a few well-performing funds so that you can assess the performance of each fund closely and take timely decisions, if required.

- While the short-term underperformance of your fund should not trigger you to exit it, a prolonged history of underperformance as compared to the category, along with other factors such as a change in fund manager, a rapid increase in expense, etc., should not hold you back from making the desired changes.

- Investors are often attracted to sectoral funds after they have already rallied. This acts as a recipe for disappointment if a correction follows. As stated above, just avoid sectoral/thematic funds and stick to vanilla flexi-cap funds.

- Remember you can only defer your tax liabilities but you cannot write them off. While you should always look for smart ways to reduce your tax liability, don't keep waiting forever due to the fear of taxes. This could ultimately be more harmful to your portfolio. For instance, if you delay switching from regular plans to direct, it may save your taxes for the time being, but you may eventually end up paying more commission on the funds, which will deplete your wealth as against what you could have accumulated by shifting to direct plans.

Don't ignore these

- It's essential to have an emergency fund equivalent to at least one's six-month expenses to meet any unforeseen financial situation.

- An adequate life cover through a pure term plan is a must if Dharmesh has financial dependents.

- He should have adequate health insurance covering all his family members.