Born in 1931 during the Great Depression, after getting poor grades in his school, John Neff joined his father's company involved in supplying industrial equipment. Sydney Robbins, Head of the Department of Finance at the University of Toledo, introduced him to the world of finance. In 1963, John joined Wellington Management and a year later, he was offered the position of Windsor Fund's portfolio manager. From 1964 to 1995, he delivered returns of 14.8 per cent as against 10.6 per cent given by the S&P 500 index.

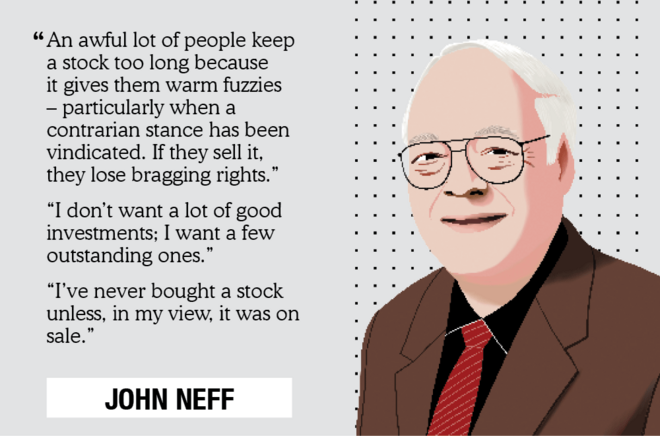

Neff followed a simple investment approach - buy what is cheap. However, he did not mean here the stock's price but its value. It means that if a stock trades below its fair value, then, according to Neff, it is worth buying. He always stayed away from the famous stocks of the market and consistently looked for stocks with low price-to- earnings (P/E) multiples. He was such a textbook value investor that an average Windsor stock had a P/E of almost 60 per cent less than the market average. This helped him achieve consistent returns over a span of 31 years and beat the market returns.

Methodology:

In order to get John Neff type of companies we applied the following quantitative filters:

- P/E less than 15

- Positive free cash flow in last three years

- Sales and earnings growth in the last 5 years between 7 per cent and 50 per cent

- ROE more than 15 per cent

- Total return ratio of more than 1 (Total return ratio is arrived by dividing 5Y EPS growth plus dividend yield by current P/E)

Using the above-mentioned filters, we, at Value Research, have created a list in our stock screener which you can access anytime. You can head over to John Neff stock screener page.

In today's time, the relevance of John Neff 's investment philosophy hinges on how investors interpret it. His philosophy focuses on buying companies trading below their fair value and P/E is a mere tool for that instead of the sole consideration. The philosophy will remain relevant throughout time as long as investors equate 'cheap' with a stock's value instead of its price.

Also in the series:

How to pick stock the Buffett and Munger way