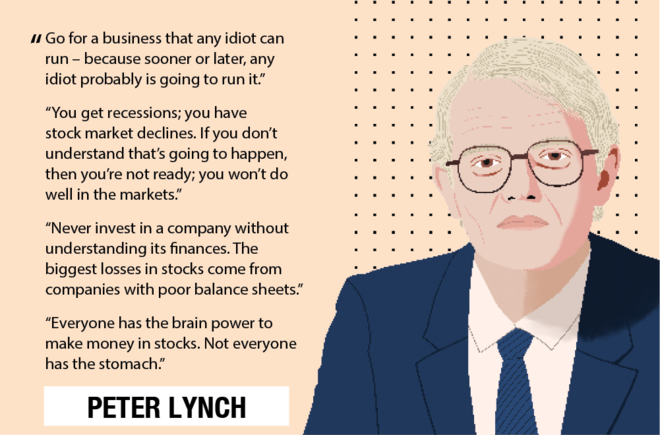

Peter Lynch, a mutual fund manager in the US, was at the helm of the Fidelity Magellan Fund for 13 years. During his tenure, the fund's AUM grew from $18 million to $14 billion, gave investors an annualised return of 29 per cent and was the top-ranked equity mutual fund. Investors who had initially invested with the company saw their wealth multiply 27 times. Peter Lynch's approach focuses on looking at those companies that stay away from the limelight, sectors temporarily unpopular due to external circumstances and searching for investment ideas from day-to-day experiences.

Lynch believes that an average retail investor, backed by the right tools, could easily beat professional fund managers on Wall Street. These principles have been elucidated in his three books, namely 'One Up on Wall Street', 'Beating the Street' and 'Learn to Earn'. Retail investors reading about Peter Lynch can benefit in two major ways. One, they can realise the inherent advantages that retail investors possess over fund managers. Some of these advantages include the absence of any restrictions on buying small-cap stocks, their ability to spot great companies during day-to-day interactions and so on. Two, these books give real- life examples of both Lynch's successes as well as failures.

Methodology:

In order to get Peter Lynch type of companies we applied the following quantitative filters:

- 5Y earnings growth more than 15% but less than 30%

- Debt to equity of less than 1

- ROE of more than 15%

- P/E less than 15

- Institutional holding less than 30%

- Should be a net-cash company

Using the above-mentioned filters, we, at Value Research, have created a list in our stock screener which you can access anytime. You can head over to Peter Lynch stock screener page.

The fundamental principles of Lynch's investment lessons are simply timeless in nature. Ideas such as investing in businesses that can be illustrated with a crayon (avoid Bitcoin and businesses with complicated business models), sidestepping the urge to worry excessively (continue sticking to investments in solid companies through bad times), and the correlation between management extravagance and poor shareholder returns are always going to be useful for long-term investors.

Also in the series:

How to pick stocks the Buffett and Munger way

How to pick stocks the Benjamin Graham way

How to pick stocks the Joel Greenblatt way