A suitable investment option, the National Pension System or NPS (Tier I) comes with strong merits like extra low expenses, additional tax benefits and so on. Although its long lock-in period is generally seen as a disadvantage, it is a blessing in disguise for investors who find it difficult to be disciplined with their retirement savings.

During this tax-saving season, we bring to you a comprehensive comparison of different NPS plans and shed light on the best ones.

When it comes to investing in the NPS, an investor can opt for any of the seven pension fund managers [Aditya Birla Sun Life (ABSL), HDFC, ICICI Prudential, Kotak Mahindra, LIC, SBI and UTI Retirement Solutions] and three plans offered by each (equity, corporate bond and government bond). We have not considered alternative investments, which can at best get the allocation of 5 per cent, in this study.

Best in the equity segment (Scheme E)

According to regulatory-investment guidelines, this scheme mainly sticks to the universe of large- and mid-cap stocks. In terms of their overall portfolio construct, all equity plans of NPS Tier I are conservatively managed, with about 95 per cent money invested in large-cap stocks. Thus, the portfolio complexion of all these funds remains the same. However, when it comes to performance, one can easily pick the winner.

An evaluation based on rolling five-year returns reveals that the best and the worst plans generally differ by about 2-2.5 per cent per annum. And it can make a big difference to your overall wealth in the long term.

However, unlike mutual funds, the best and worst plans in the case of NPS equity plans have remained consistent. On the basis of five-year rolling returns, LIC has always been at the bottom since its launch, while HDFC has remained at the top almost 90 per cent of the time. In addition to delivering the best returns, HDFC has also managed to contain the downside better. Deservedly, it has the largest AUM and continues to be the best pick. Besides these two, others are tightly packed in the highly competitive middle.

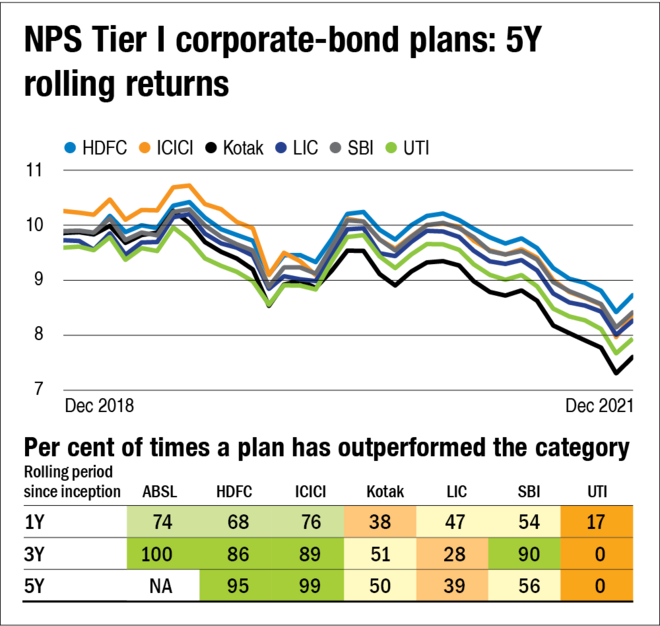

Best in the corporate-debt segment (Scheme C)

Most corporate plans almost fully invest in top-rated bonds. However, only SBI currently has some presence in slightly lower-rated ones (as of November 2021). The average portfolio maturity has also hovered in a narrow range of five to seven years with very limited active management. This means that these plans prefer to buy and hold bonds till their maturity.

When we look at their performance, there is not much difference, with the difference between the five-year rolling returns of the best and worst plans hovering about 0.75-1 per cent per annum. Nevertheless, the corporate-bond plans of ICICI Prudential and HDFC stand out for being ahead of others most often, followed by SBI. On the other hand, UTI has lagged the most. Although Kotak started off well, it has turned disappointing in recent years. Notably, ABSL made a promising start but doesn't have enough history for the comparison on the basis of five-year returns.

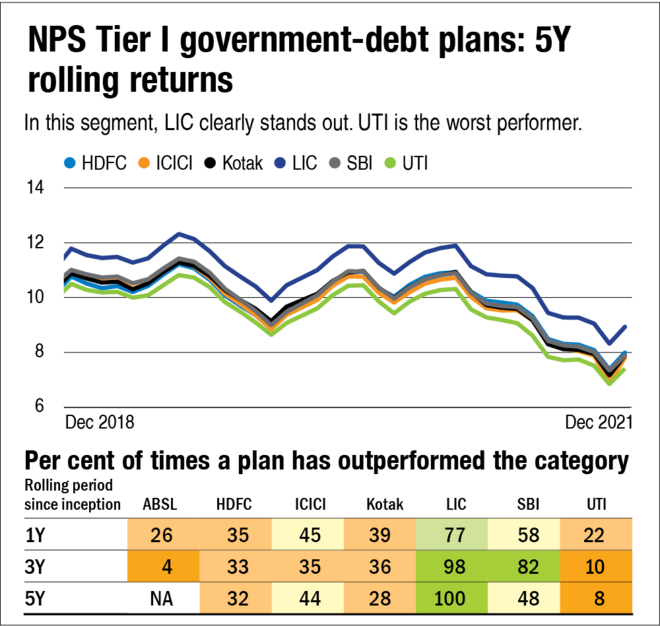

Best in the government-debt segment (Scheme G)

Government-securities plans usually invest in bonds of high maturity. The average maturity of their portfolios usually remains above 10 years. Nevertheless, given the long-term investment horizon of the NPS, this duration is fine.

A close look at the performance numbers reveals that nothing beats LIC's management skills. The plan offered by LIC has consistently beaten others and by a notable margin. On the other hand, UTI turns out to be the most disappointing one.

So, now you know which of NPS schemes stand out within each segment. But how can you build your NPS portfolio out of the different NPS plans? Read the last part of this series to find out!