In the first part of the 'NPS' series, we compared different NPS plans comprehensively and shed light on the best ones. Here we discuss how you can make the most of this retirement tool.

Choosing the right combination of asset classes

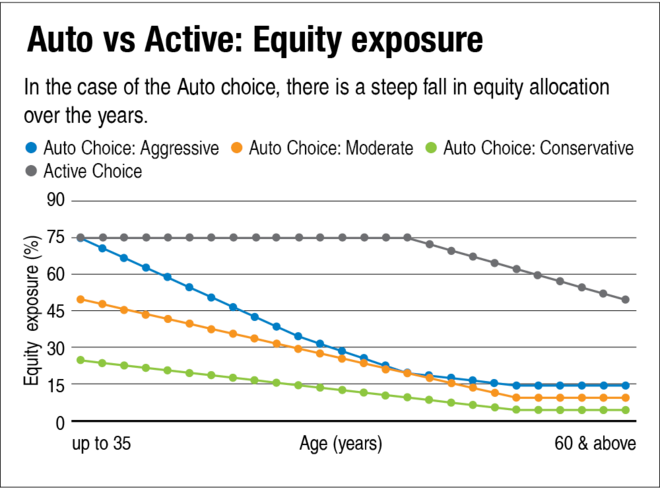

NPS allows you to select either the 'Auto' or 'Active' choice option. In the first option, your money is automatically divided across different asset classes on offer. To reduce risk, these allocations are adjusted based on the investor's age. The sub-options here are - Aggressive Life Cycle Fund (LC75), Moderate Life Cycle Fund (LC50) and Conservative Life Cycle Fund (LC25), with the maximum equity allocation being 75, 50 and 25 per cent, respectively, up to the age of 35. After that, the equity allocation reduces every year.

On the other hand, the 'Active' choice option gives investors the flexibility to decide the allocation between equity and fixed income. Investors up to the age of 50 can allocate a maximum of 75 per cent to equity. After 50, the maximum equity component reduces by 2.5 per cent every year till it reaches 50 per cent.

In the 'Auto' choice, one ends up paring down the equity exposure too aggressively, thus affecting the returns potential. Given that the NPS funds are a long-term investment avenue, one shouldn't curtail equity exposure much. It is highly desirable to go for the maximum possible exposure to equity. So, keep it simple and go for the 'Active' option.

Having said that, don't overcomplicate the 'Active' choice. For most people who have over 10-12 years ahead of them, it is highly desirable to go for maximum equity (75 per cent) in the NPS funds till possible. Over such a long timeframe, equity will be able to work its way through and provide meaningful impact. For the remaining 25 per cent, you can equally allocate between the corporate and government plans to have diversity on the debt side. But if market volatility makes such investors nervous, start with an allocation of 50 per cent to equity and divide the other half equally between corporate bond and government plans. Later, you can look to reduce your equity allocation to 25 per cent.

Which provider to choose?

Our above analysis shows that different pension fund managers do well in managing different asset classes. But the NPS funds do not allow you to cherry-pick a different pension fund manager for each asset class. An investor can only invest with one NPS fund manager.

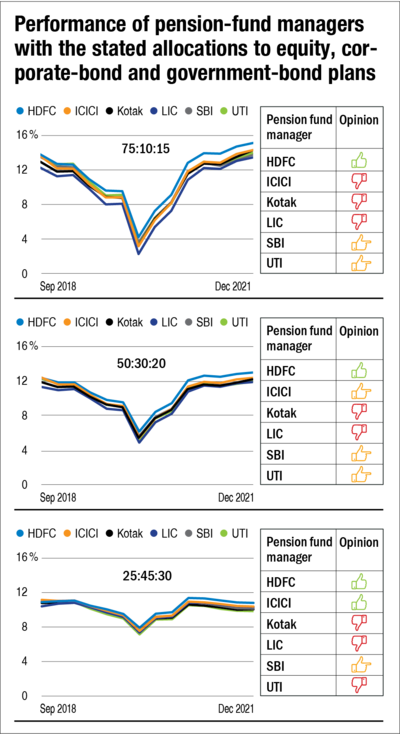

To find out which one trumps over the other, we did a comprehensive study of six NPS fund managers, considering three asset allocations 75:10:15, 50:30:20 and 25:45:30 divided between their respective equity (Scheme E), corporate bond (Scheme C) and government plan (Scheme G) with annual rebalancing. We calculated their five-year rolling returns from 2013 to 2021 to identify the most consistent outperformers. Results are depicted in charts 'Performance of pension-fund managers with stated allocations...', along with our preferred fund manager for each asset allocation. Since ABSL is a relatively young pension fund manager and this study is based primarily on rolling returns, we have left ABSL out of this analysis.

As the results show, HDFC beats other NPS fund managers most consistently, even with different combinations of equity, corporate bond and government bond. Having said that, returns can be further improved if the PFRDA, the pension regulator, allows investors to choose different pension fund managers for different asset classes. In that case, we would go for HDFC's equity plan, ICICI's corporate-bond plan and LIC's government plan. But that option isn't available as of now.