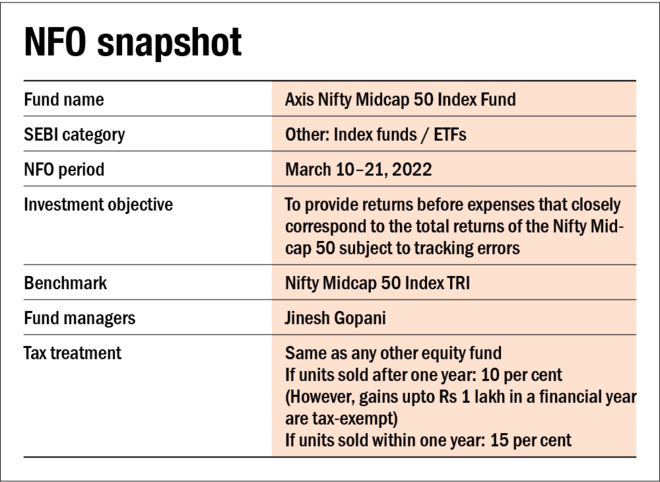

It's been raining passive funds in the mutual fund industry for the last couple of quarters. Fund houses have now started joining this bandwagon even for their mid-cap and small-cap products. Now, Axis Mutual Fund has rolled out an index fund, Axis Nifty Midcap 50 Index Fund in the mid-cap space on March 10, 2022. The new fund offer (NFO) will close for subscription on March 21, 2022.

About the strategy

The Axis Nifty Midcap 50 Index Fund would be the first index fund to mimic 'Nifty Midcap 50 TRI'. However, Kotak was the first fund house to track this index with the launch of its Kotak Midcap 50 ETF in January 2022.

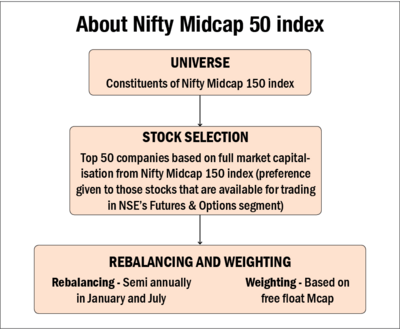

Nifty Midcap 50 index comprises the top 50 stocks based on full market capitalisation from the Nifty Midcap 150 index (representing 150 companies ranked 101-250 as per full market capitalisation from the Nifty 500 index). Thus, the primary objective of this underlying index is to capture the movement of the midcap segment of the market.

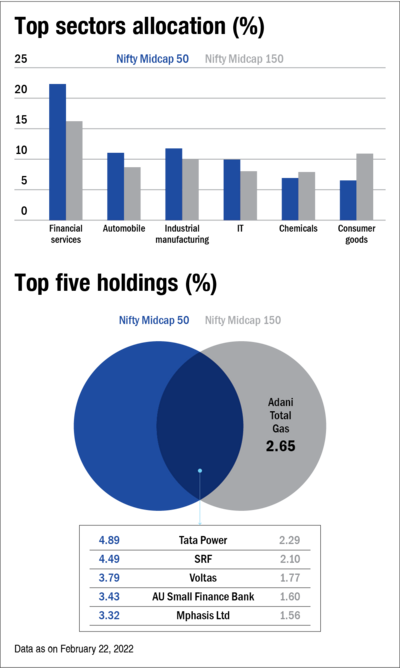

As this index captures the top 50 companies from the universe of Nifty Midcap 150, there are some subtle and not-so-subtle differences between the two indices. First, the top five sectors are broadly the same; however, their weightage in the Midcap 50 index is slightly higher. Further, the top five holdings make up only 10 per cent of the Midcap 150 portfolio, but it is almost double in the case of the underlying index of the fund under consideration.

Mid-cap funds have been in the limelight lately due to the post-covid recovery on the bourses. While such funds can provide higher returns vis-à-vis diversified equity funds such as flexi-cap funds over the long term, this comes at the cost of relatively higher risk, given that they invest in less mature companies. At Value Research, we believe that mid-cap funds add value in the long-term, aggressive growth portfolio. But they are meant to be a supplementary holding, which means that investors should avoid allocating more than 15-20 per cent of their portfolio into them.

About the performance

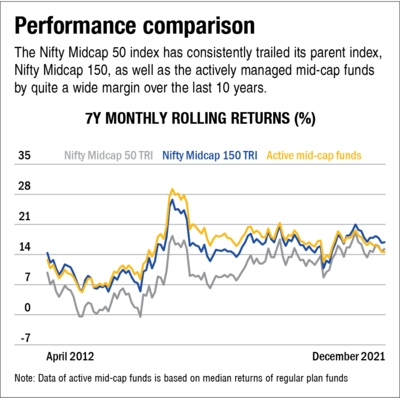

Amid the growing interest for passive investing, we see that in the mid-cap space, the majority of the actively managed funds have beaten the index comfortably (see 'Performance comparison') till mid-2020 but have slightly trailed subsequently. However, the Midcap 50 index (a subset of the Midcap 150 index), which this new fund is going to track, has consistently lagged over the last 10 years against both the actively managed mid-cap funds as well as its parent index. Investors should note that these are historical trends and cannot be extrapolated into the future.

About the AMC

Axis Mutual Fund launched its first scheme in October 2009. 75 per cent of the AMC is owned by Axis Bank, while the remaining 25 per cent is owned by Schroders plc, a UK-based asset manager.

It has a diversified asset class mix across equity, fixed income and hybrid funds. As of February 2022, it ranks seventh in the 42 players industry, managing around Rs 2.54 lakh crore of investors' money across 54 open-end schemes. Of this, the share of equity funds is Rs 1.40 lakh crore which is spread across 24 funds. However, when it comes to passive equity funds, it is a far cry from the kind of money it manages in the active space. Currently, the fund house manages eight passive equity funds (index funds and ETFs) which together comprise about Rs 1,065 crore, making the AMC rank 11th in the passive equity funds space.

Also read: 3 questions you should ask before investing in an NFO