We are encountering the most action-packed week for tax-saving investments. And while there are plenty of options to choose from, most investors do not have the time or the inclination to evaluate them thoughtfully. For many investors, saving tax itself is the main objective and the eligibility for tax deduction under Section 80C is the sole feature that gets their nod in the last-minute rush.

Clearly, that's not the right way to invest. Investments made to save taxes have big implications for the personal finances of a majority of investors, given that one puts Rs 1.5 lakh at stake each year. This would become bigger if and when the tax-saving limit is enhanced.

If you are unable to find your way through the maze of tax-saving alternatives, this story is for you. We present a simple and effective way to sift through the options and narrow down to the most useful ones depending upon your investing needs.

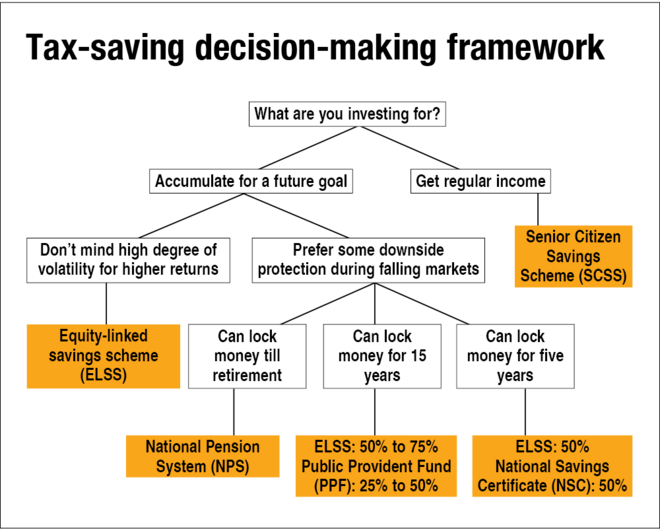

Before we get into the details, keep in mind that tax-saving is just an added benefit of such investments. Your investments must first align with your investing and liquidity needs as well as your risk appetite. Keeping that as the central idea, you can use the flowchart 'Tax-saving decision-making framework' for some ready-to-go tax saving plans.

The flowchart takes into account your investment needs, risk appetite and liquidity requirements. It will help you zero in on the most suitable investment. Use it to make a quick decision, though there is also a detailed table 'Tax-saving investments under Section 80C' that compares these and other popular alternatives across important parameters.

Confused between the old and new tax regime? This tax calculator gives you the answer.

Here are a few points to note:

- The flowchart is only about investments. You also get tax benefits on insurance premium and certain other expenses but our story focuses only on investments.

- All tax-saving investments have lock-in periods, so they align only with medium- to long-term goals. ELSS has the shortest lock-in of three years, but that's too short a timeframe. If investing for three years, you carry the full risk but don't enjoy the full return potential. We recommend that to save tax, you invest only that money which you can keep invested for at least five years.

- If you have a five-year investment horizon, your tax-saving investments must have a high allocation to equity instruments. Given that this money will remain invested for a reasonable time, putting it away only in fixed-income investments is inefficient. The suggestions in the flowchart have a good allocation to equity. The income goal is the only exception, and we will explain the reasons for that.

Subsequent parts of the story:

Tax saving plan: SCSS and ELSS