In the second part of the story, we discussed the best tax-saving options available for you as per your needs. Now let's continue further.

Seeking accumulation but prefer some cushion from market volatility

Imagine how someone on a saatvik Indian diet would react if served burgers and fries! People who have never invested beyond the PPF and tax-saving bank deposits react the same way when asked to switch to ELSS. While one should go for stuff as per one's risk appetite, it's more important to have a more balanced view.

Don't make the mistake of looking at your tax-saving investments in isolation. They should be part of your overall portfolio. So, putting the entire tax-saving investment in an ELSS should be perfectly fine for someone who has sizeable other investments in fixed-income securities. However, if you don't have other savings and are not comfortable with a high allocation to equity, other features such as returns and liquidity become more important.

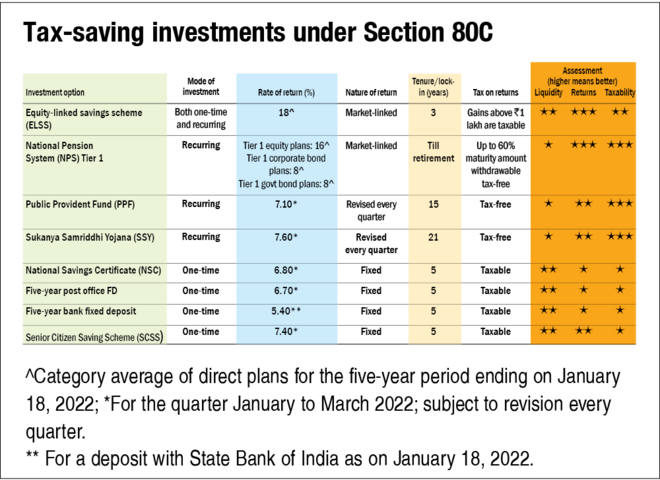

When it comes to the other tax-saving options, liquidity and returns are directly related. Schemes that offer the highest returns also have longest lock-in periods. As the lock-in comes down, the returns offered are lower. Figure out which liquidity bucket is most suitable for you to identify the best tax-saving option.

Can lock the money till retirement: The NPS beats all else and it should be your go-to option. In fact, the NPS offers an additional deduction of Rs 50,000 over and above the Rs 1.5 lakh limit under Section 80C. This deduction is specific to the NPS and not available for any other investment. You can opt for the auto choice where the equity-debt allocation depends on your age and follows a specific glide path. Or you can choose the active choice where you determine the asset mix with a 75 per cent cap for equity. It's better to go for the latter with the maximum permitted equity allocation if you have more than 10-12 years to retirement. It gives you a good chance to build a big retirement portfolio. Your investments will rise and fall with equity markets but you will realise the benefit once you are through one or two market cycles. The NPS combines ultra-low cost, conservative investment style, mandatory lock-in and market-linked return potential in a convenient package. We have analysed the plans offered by different NPS fund managers. Read 'Which is the best NPS plan' to find the best ones for you.

Confused between the old and new tax regime? This tax calculator gives you the answer.

Can lock the money for 15 years: The best option for you is a combination of ELSS and PPF, preferably in a 75:25 ratio. If you want to play it safer, split in a 50:50 ratio but don't reduce ELSS more than that as the return potential will also come down. You can rebalance this allocation through incremental investments every year. For example, if the ELSS runs up substantially in a year, you can allocate more to the PPF the next year to restore the original asset mix.

The 7.10 per cent per annum tax-free guaranteed return offered by the PPF is very impressive on the fixed-income side. Those looking to save for a girl child may consider replacing the PPF with the Sukanya Samriddhi Yojana (SSY), provided you are eligible, partly or fully. It offers 7.6 per cent per annum tax-free.

Can lock the money for five years: If 15 years is too long for you, the next best alternative is National Savings Certificate (NSC), which has a lock-in of five years. At 6.8 per cent, the interest rate is lower than the PPF but better than other alternatives of a similar duration, such as tax-saving bank FDs and post-office time deposits. Here again, it is advisable to have about 50 per cent in ELSS and rebalance with incremental investments.

Other parts of the story: