In the Independence Day speech of 2021, Prime Minister Modi announced the setting up of the National Hydrogen Mission to make India self-reliant in energy and become a global hub for green hydrogen. In February 2022, the government announced the policy for green hydrogen to help set up the hydrogen ecosystem. This policy allows (a) manufacturers to set up renewable-energy capacity for green hydrogen anywhere in India; (b) time-bound open access approval for 25 years, without central surcharge and zero inter-state transmission charge for projects commissioned before H1CY2025; (c) 'bankable' storage of generated power for 30 days (d) for storage of green H2 for exports at facilities near ports. The policy also provides for statutory clearances to be provided within 30 days of application.

India is not the first country to announce steps to generate energy from hydrogen. White House archives reveal: "President Bushs Hydrogen Fuel Initiative, announced on January 28, 2003, envisions the transformation of the nation's transportation fleet from a near-total reliance on petroleum to steadily increasing use of clean-burning hydrogen". Fast forward to 2014, the Government of Japan announced a "strategic roadmap for hydrogen and fuel cells". The stated objective was to convert the economy to hydrogen.

Why is it that after almost two decades, we are still to see widespread adoption of hydrogen as a fuel?

How 'green' is current hydrogen

'Burning' hydrogen with oxygen from air produces water while releasing energy. What could be cleaner than that? The issue we confront is that hydrogen is not available in nature. It appears as ammonia, methane, water and other molecules and needs to be released through a process that needs energy. The most common process to manufacture hydrogen is through 'reforming' of natural gas. Steam-methane reforming (SMR) makes up 76 per cent (IEA, 2019) of global hydrogen production. The process generates carbon dioxide and is not 'green', although combined with sequestration techniques, SMR can reduce the overall release of CO2.

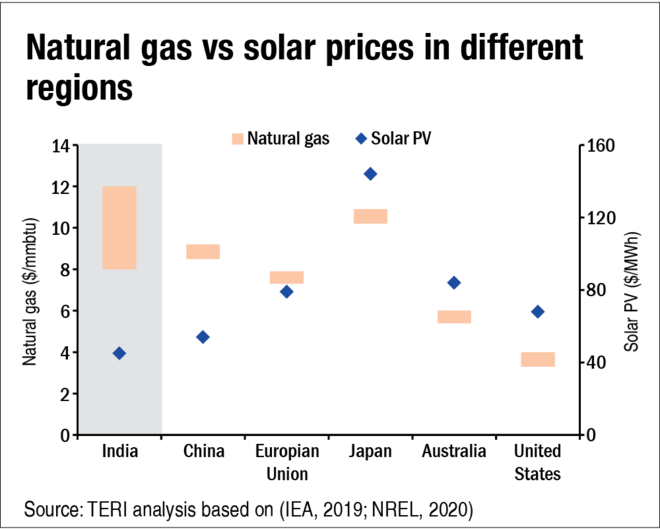

The Energy and Resources Institute (TERI), in its report 'The Potential Role of Hydrogen in India', estimates the cost of hydrogen produced without carbon capture and storage (CCS) at Rs 130/kg to Rs 180/kg, depending on the price of natural gas. This is grey hydrogen - this would still release CO2 - and there is energy loss in converting natural gas to hydrogen. It makes more sense to simply use the gas for energy. Another issue that India needs to face up to is that India is an importer of gas and the stated goal of reducing import dependence on fossil fuel is defeated. Gas-producing countries will face a cost of Rs 80/kg under similar conditions - pricing India out.

Green hydrogen refers to the use of renewable energy sources to electrolyse water to produce hydrogen. India has managed to reduce its cost of solar significantly. Some of the gains have recently been ceded by imposing duties on imports from China. Despite this, price quotes for solar bids have consistently fallen, making India among the cheapest producer of solar power in the world. Globally, only about 4 per cent of hydrogen produced is through this source.

Despite this, TERI estimates a high levelised cost of hydrogen using electrolysis. "Costs of hydrogen from electrolysis today are relatively high, at around Rs 400/kg versus Rs 140-180/kg from natural gas reformation. However, as the costs of electricity and electrolysers fall, the efficiencies of electrolysers improve, and the average load factor for renewables improves, we can expect costs of green hydrogen to fall to around Rs 150/kg by 2030 and Rs 80/kg by 2050." It is here that one of the policy initiatives of the government can help reduce cost - usually grid-connected solar costs more due to wheeling charges and other charges imposed by the grid owner. The policy seeks to do away with these charges.

Transportation as a use case

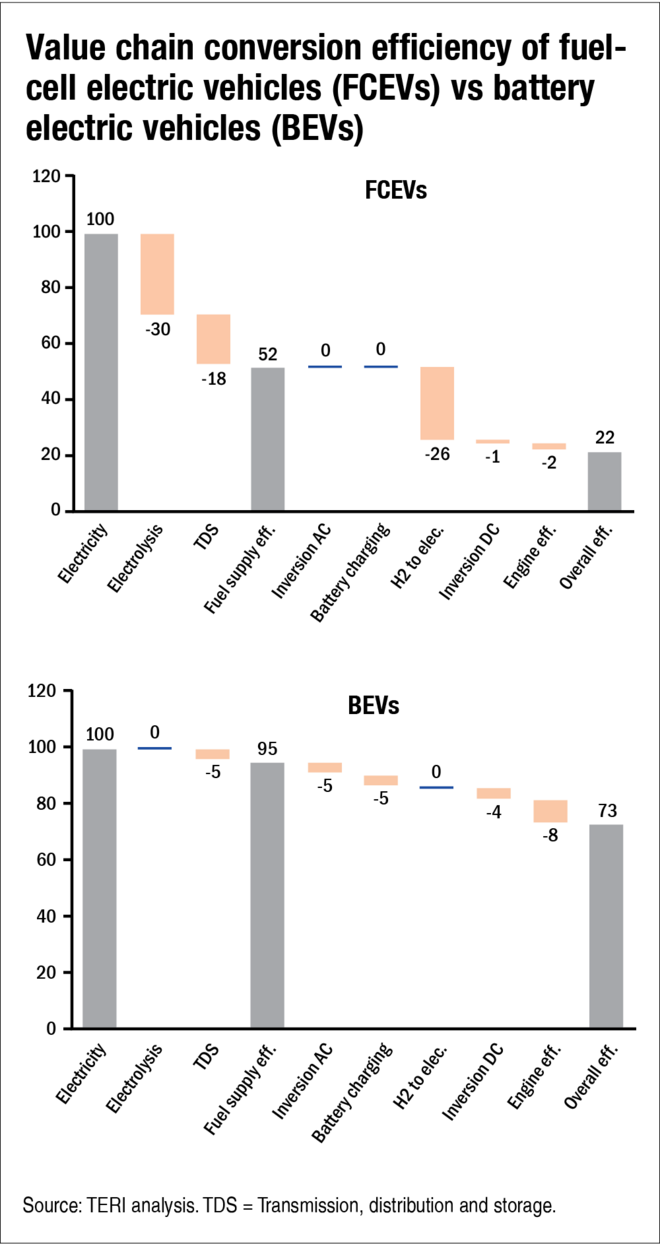

Hydrogen has a high energy density by weight (over three times of gasoline) but because it's a light gas, it has almost four times less energy by volume compared to gasoline. Assume a car that delivers a mileage of 15 km/litre. Filled with liquid hydrogen, it will deliver 4 km/litre, and about half of that if one used compressed hydrogen. Compressed hydrogen requires high-pressure cylinders (which increases vehicle load and prices), and making H2 liquid requires it to be cooled below -253 oC. Hydrogen can be used as transportation fuel for buses and commercial vehicles - those can hold larger fuel tanks and stop at more frequent intervals. Similarly, because of the significant loss in conversion of energy to make hydrogen, anything that can be directly connected to electricity, should be. A comparison between battery electric vehicles (BEVs) and fuel-cell electric vehicles (FCEVs) is illustrative.

TERI points out that in FCEVs, only 22 per cent of input energy is used to power the car while in BEVs, the conversion is almost 73 per cent.

Many false dawns

Perhaps with greater urgency in achieving lower carbon emission, policy and technological developments may accelerate in finding cheaper and more efficient methods to use hydrogen. An important thing to remember is that hydrogen is not a source of energy, it's a way to transport energy. And transportation of hydrogen requires pipelines. Large green-hydrogen production facilities need to be near demand centres as pipelines to carry hydrogen can get expensive.

In India, RIL has projected an outlay of $10 billion over the next three years in developing capability across the value chain. Renew and L&T have announced a partnership to develop, execute and operate green hydrogen projects in India. Hydrogen itself is expected to drive 120 GW of renewable electricity demand by 2040.

As with every gold rush, it's the toolmakers who benefit. While the path to profitability for hydrogen fuel is unclear, the demand for solar PV, batteries, and electrolysers is definite. Investors in these 'tools' are likely to witness a smoother ride into the future.