For a long time now, perhaps almost two years, I have written this page every month, talking about investors' mutual fund investing needs and how Value Research Premium solves them.

Based on some interactions I have had this month, I have decided to eschew the theory and go straight for the practice while focusing on the star turn of our Premium service, the Portfolio Planner. So, let me take you through a quick and focused walkthrough of what you will do and what you will achieve in Portfolio Planner. Readers of 'Mutual Fund Insight' know enough about mutual fund investing to see what they can achieve using these features.

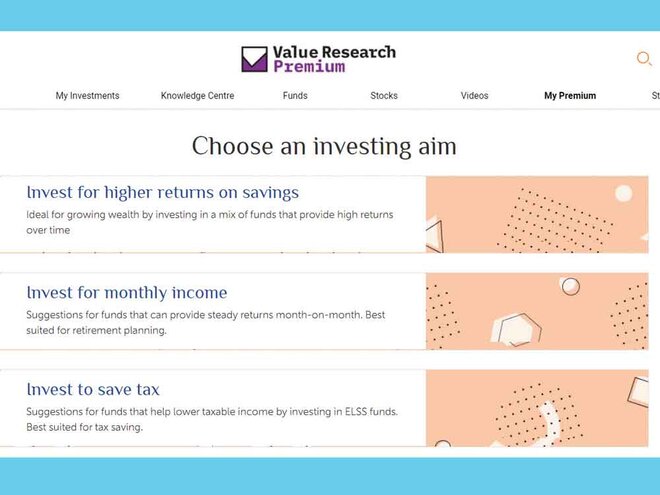

When you start 'Portfolio Planner,' you see three options. Here they are, along with the brief explanation you will see:

Invest for higher returns on savings: Ideal for growing wealth by investing in a mix of funds that provide high returns over time.

Invest for monthly income: Suggestions for funds that can provide steady returns month on month. Best suited for retirement planning.

Invest to save tax: Suggestions for ELSS funds that help lower taxable income

Let's see what you get from the first option, 'Invest for higher returns on savings'.

As you choose this option and proceed further, our algorithm asks you the following question: Do you need to save tax through your investments? If you answer yes, you get a series of straightforward questions: how much do you need to invest to save tax this financial year (there's a helper for this question)? Excluding the tax-saving investment mentioned above, how much more can you invest? How much can you invest upfront? How much can you invest every month? How long do you want to invest?

Once you answer these questions, there's a question about your annual income, and then we show you a list of funds chosen by our analysts, out of which you can choose.

So, let's see what happens when you choose no to the tax-saving question. You are asked the same questions, except the tax-saving one, and you are given a list of funds after asking you your annual income.

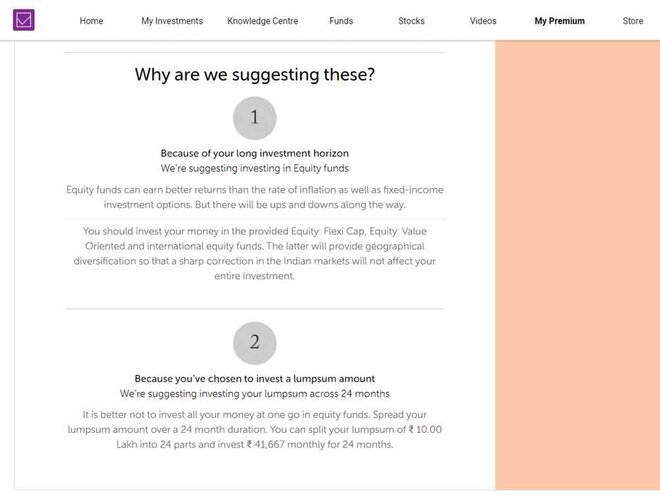

The list of funds that we give you has another section at the bottom, which is in some ways the most important part of the experience and the service. This section says, 'Why are we suggesting these?' Again, instead of the theory, let me just give you an example, a full quote from an actual recommendation: Because of your medium investment horizon, we're suggesting investing in aggressive hybrid funds. These funds invest 65-80 per cent of your money in equity shares and the rest in bonds. Since your investment duration is not too long, it is prudent to invest a portion of your money in bonds to provide some cushion in case the equity markets decline sharply. Therefore, we believe that the provided aggressive hybrid funds should suit you. Their returns are slightly lower than pure equity funds, which invest all your money in shares, but they also tend to fall less when the stock markets decline.

Of course, most of our readers are so knowledgeable and curious about investing that they are not satisfied with just this. They would like to experiment with the system, as they should. Only by experimenting does one learn. They go back and change some inputs and try again. They try different income levels, different answers to the tax questions, different time horizons. When they do this, they find that the list of recommended investments often changes. Here's the one that initially puzzles a lot of them. If you keep everything else constant but only change your income or the amount you have, the recommendations change. Why so?

Because, like any good advisor, our algorithms know that investments should change depending on who you are. A Rs 10,000 a month investment means something very different if your monthly income is Rs 1 lakh or it's Rs 4 lakh. Now that I point this out, it looks self-evident.

Investors are often too focused on externalities like the markets or wars or pandemics or interest rates or something else that the news keeps talking about. Sure, all those are important but only in the context of your own financial life.

Value Research Online Free vs Premium

This is the key difference between our free service and Premium. The free service is the best free source on data, information and knowledge, but it's not about you - it's about funds and stocks. Premium is about you - it's an algorithmic system that takes your financial life into account while generating what it should recommend that you do.

Portfolio Planner is just one part of what it does, although it is the most important for most of our thousands of members. Here's a lot more, but the theme is the same:

Analyst's Choice: Often investors want to choose their own funds for some particular investment purpose. There are over 1,500 available to you and even with the help of our rating system, it's a lot of work to zoom in to the right set. However, that won't be a problem for you because as a Premium member, you will have access to Analyst's Choice. Instead of the 37 official types of funds, we have created eight investor-oriented categories which match precisely with actual financial goals that you have. In each of these, my team of analysts and I have carefully selected a handful of funds that will serve you with the best outcomes.

Portfolio Analysis: While some members may be starting from scratch, a big question for others is whether your existing investments fit into your goals? This is often a hard question to answer because there are a lot of implications of switching old investments, not the least of which is taxation. In the Premium system, you can get an evaluation and a suggested fix-list based on our expert teams' inputs.

A lot more

Of course, those are just headline features. There are a lot more that will help you keep track of your investments, returns, diversification, taxation and practically everything else that will help you achieve your financial goals. Take a look at Value Research Premium for the full details. You could also check out Value Research Stock Advisor.