Debt funds play an important role in de-risking and stabilising your investment portfolio. At Value Research, we have always preferred short-duration funds to be the core of your fixed-income allocation. After a drop in the aftermath of the IL&FS crisis, the category's assets have risen substantially.

That said, due to the pandemic and the consequent low interest rates, we are seeing most fixed-income funds deliver low returns. This category has been no different. This has raised questions as to whether these funds are still relevant vis-a-vis fixed deposits.

Short-duration funds vs fixed deposits

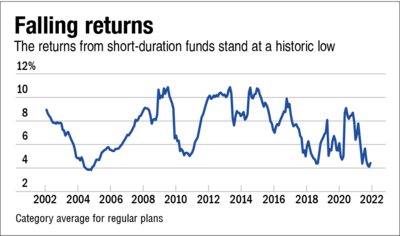

If you look at the one-year rolling returns, the category of short-duration funds is currently standing at one of its lowest return levels in history.

This has made many investors contemplate shifting to FDs for now and later moving to these funds. While FDs look good on a pre-tax basis, their returns go awfully low when you factor in the taxes. In terms of liquidity also, short-duration funds fare much better.

What's with the volatility?

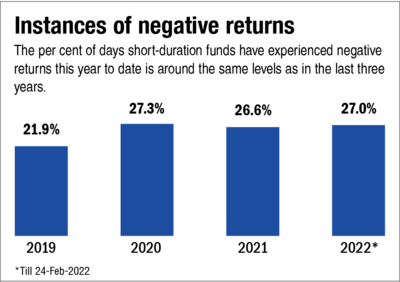

While it's common for equity markets to witness commotion now and then, the ups and downs in the debt markets are also ruffling some feathers these days. Some investors have been enquiring, somewhat worriedly, about the instances of negative returns they are experiencing with their debt funds since the start of the year. So here we put things in context.

The category of short-duration funds has reported negative returns (on average) on a little over a fourth of the total traded days this year. This is pretty much in line with the trends in the preceding three years. Therefore, these funds aren't reporting negative returns on more days than they had in the past. Even the magnitude of the fall isn't any higher. So, nothing much has changed on that front. But admittedly, we are in a noisier environment due to an uptick in inflation and the unfolding global macroeconomic factors. On one side, RBI has vocally stated its intention of staying accommodative and supporting economic growth. That means that RBI will not hurry to raise interest rates. On the other side, macroeconomic factors are suggesting an imminent rate-hike cycle. For instance, globally, inflation has been on the rise, particularly in developed markets and thus, a constant worry for months now. The US Federal Reserve has already hiked rates by 0.25 percent. Even domestically, a higher-than-expected borrowing programme in the coming financial year is likely to apply an upward pressure on interest rates. The unfolding Russia-Ukraine conflict may exacerbate that.

So, even though there are expectations of interest-rate rising, its pace is anybody's guess. Thus, the debt market will look to pick up cues from and react to the unfolding developments, which will likely contribute to short-term volatility. But it should not be a cause of concern if you are investing in these funds for more than a year at the very least. By design, short-duration funds are well-equipped to handle such market phases.

What about the recent PRC matrix disclosures?

Recently, debt funds started reporting a new risk-related metric, called the 'Potential Risk Class Matrix', or PRC. This matrix provides a snapshot of the maximum interest-rate and credit-risk a fund can undertake. On this 3 × 3 matrix, every fund house has placed its debt funds in one of the nine cells. For instance, cell A-III means that a fund placed in it will largely stick to high-rated bonds but will have the flexibility to invest in bonds maturing in more than seven years. Therefore, you can expect an A-III fund to be always low on credit risk but potentially high on interest-rate risk. Do note that the risk-class matrix sets the maximum level of credit risk and interest-rate risk a fund will ever take. On an ongoing basis, the fund manager can choose to run the portfolio at a lower level of risk. For example, a fund that sets its PRC at B-II can well run a portfolio at A-I, A-II or B-I levels as well.

Do note that you don't have to make any changes to your portfolio based only on the PRC matrix. Just be watchful if your fund has retained a high degree of flexibility to assume greater risk in the future. To check the placement of short-duration funds on this matrix, see the infographic 'Placement of short-duration funds on the PRC matrix'.

Portfolio moves

The charm of short-duration funds lies in their ability to use active management within a controlled environment. By staying within narrow, well-defined boundaries on duration and credit calls, they can optimise returns. Such a strategy helps sail through the ups and downs of an entire interest-rate cycle.

While these funds don't oscillate to the extremes of average maturity, we are seeing the needle move a bit on the duration front in recent times. Even within the narrow band of one year to three years that they operate in, as many as 10 funds have reduced their Macaulay duration to less than 1.75 years over the last year. This implies that they are exiting from bonds with a longer maturity period and investing in those with a shorter maturity. So, if interest rates go up, they benefit from re-investing the money at higher interest rates. Hence, while short-term funds also get impacted by rising rates, they don't give investors sleepless nights.

Our take

Short-duration funds are truly all-weather, given their versatility and long-term performance record. From here on, these funds might witness some turbulence when rates rise, but over a reasonably long horizon of two years or more, they should not disappoint you. Of course, other debt-fund categories, such as credit-risk funds, can yield much higher returns. But they would invariably come with much greater risks which most fixed-income investors dislike. So, keep calm and carry on.