A fixed deposit with a bank can be renewed or extended multiple times on maturity for a similar duration for which the deposit was made initially. But do note that though the fixed deposit gets extended for the same period, the rate of interest doesn't remain the same. On renewal or extension, the fixed deposit gets re-invested at the rate of interest as applicable on the date of renewal or extension. For instance, Union Bank of India is currently offering an annualised return of 5.30 per cent on a fixed deposit of three years.

However, do note that fixed deposits with a lock-in period of three years are not eligible for tax benefit under section 80C of the income-tax act. To be eligible for a deduction from taxable income, a fixed deposit must have a lock-in period of five years. In other words, only specific five-year tax-saving fixed deposits, which do not allow premature closure, are eligible for a deduction from taxable income under section 80C. So to avail a deduction for the assessment year 2023-24, you would have to invest in a similar deposit with Union Bank of India or any other bank before March 31, 2023. Union Bank of India is currently offering an annual interest of 5.40 per cent for a five-year deposit. State Bank of India (SBI) is offering marginally higher interest on a similar deposit. A five-year fixed deposit with SBI is currently yielding 5.50 per cent per annum.

Though opening a tax-saving fixed deposit is one of the most popular and easiest ways for making a tax-saving investment, it may not be the best one. Equity Linked Saving Schemes (ELSS) or tax-saving mutual funds as they are popularly known, have the potential to generate much higher returns over the long term. These are pure equity mutual funds that come with a lock-in period of three years. Though the lock-in period is just three years, it is advisable to stay invested for a longer term, at least five to seven years to reap the maximum benefit of equity.

Undoubtedly, equities are risky and volatile. That's their inherent nature. But that is more prevalent over the short term. The risk and volatility reduces on staying invested over a longer period of time. And that is why it is generally advised, not to invest in equity for goals that are less than five years away.

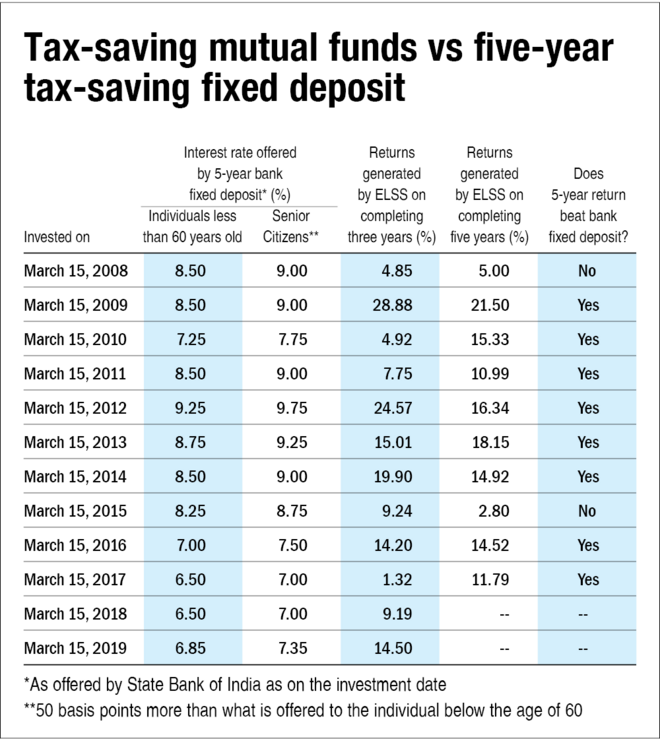

Look at the table below. We have compared the returns generated by ELSS over a three and five-year period with the returns that an investor would have earned by investing in a tax-saving fixed deposit.

We assumed two scenarios. One, the investor would have invested on March 15 every year in a five-year fixed deposit. And in the other, if he would have invested in tax-saving funds on the same date. We compared this data on a historical basis for the last decade. And as you would notice, the category average of tax-saving funds has outperformed five-year fixed deposits nearly 80 per cent of the time (eight of the 10 years) over a five-year period.

One must also note that gains from tax-saving mutual funds are taxable only when they are realised, that is on redemption. Even then, gains of up to Rs 1 lakh are exempt from taxes in a financial year. Thereafter, they are taxed at 10 per cent. On the other hand, in the case of a tax-saving fixed deposit, the interest accrued every year is added to the taxable income and taxed as per the applicable slab. So for anyone in the highest tax bracket, their return from tax-saving fixed deposit gets reduced by 30 per cent.

Additionally, one may also choose to invest in the direct plans of tax-saving mutual funds. Their expense ratio is about 1 per cent less than the regular plans as the fund company saves on the commission that they have to otherwise pay to the mutual fund agent in case of regular plans. This eventually turns out to higher returns in comparison to the regular plan of the same mutual fund scheme.

Wondering which tax-saving fund should you choose this year?

Also read: Which is the right tool to fight inflation? Equity or fixed deposits?