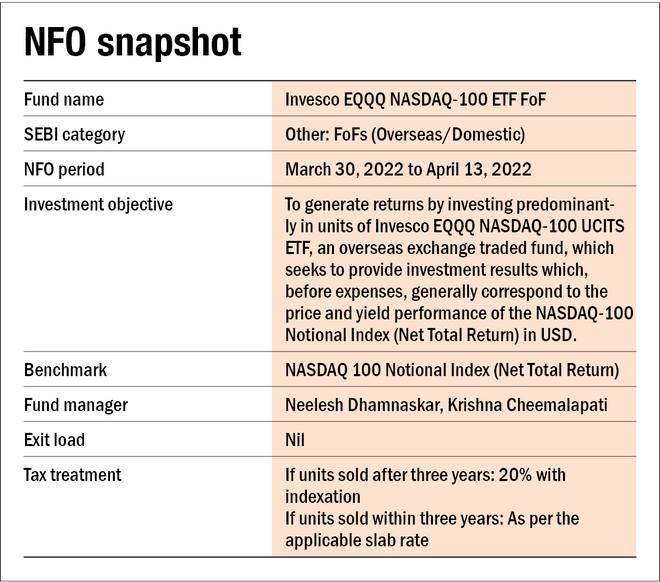

International investing is the new smash hit in the mutual fund ecosystem. A category that had 35 schemes till 2019 is now flourishing with 66 funds, a rise of a whopping 83 per cent in just about two years! Well, a lot of this can be attributed to the blockbuster post-COVID returns in global markets, particularly the US, which has enthused Indian investors the most. Then, of course, there are rupee depreciation and geographical diversification benefits as well. Joining this hot space now, Invesco Mutual Fund has rolled out a new fund offer (NFO) recently, the Invesco EQQQ NASDAQ-100 ETF FoF. The subscription period for the fund will close on April 13, 2022.

This NFO comes at a time when the mutual fund industry is on the brink of exhausting permissible foreign exposure as per SEBI rules and has therefore put gates on fresh investments in many of the international mutual funds. However, there is no impact on the schemes that invest in foreign ETFs (as also in the case of this NFO launched by Invesco) because they have a separate limit, and there is enough runway there for now. You can read more about it here.

About the strategy

The new fund, Invesco EQQQ NASDAQ-100 ETF FoF, would route investors' money in Invesco EQQQ NASDAQ 100 UCITS ETF (underlying overseas fund) that tracks the Nasdaq 100 index. Nasdaq 100 is a US index that comprises the 100 largest non-financial companies listed on the Nasdaq stock exchange based on their market capitalisation.

Although the Nasdaq 100 index is popularly known for being dominated by technology companies, it also has a decent allocation to other sectors. About 51 per cent of its assets are allocated to the information technology sector, followed by communication and consumer discretionary, with 17 per cent exposure to each, as per the data on March 25, 2022. The index undergoes a reconstitution every year in December, and the constituents' weights are rebalanced in each quarter. The top 10 holdings of the index make up around 56 per cent of the portfolio and list prominent companies such as Apple, Microsoft, Amazon and the like.

About the performance

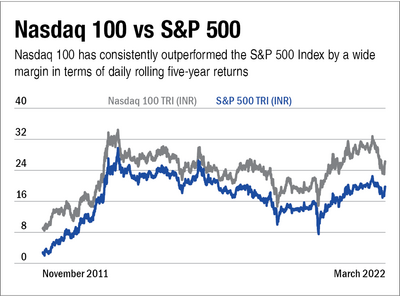

Nasdaq 100 has turned out to be a very rewarding investment avenue for Indian investors who are looking to diversify internationally. The index has returned an average of 24.5 per cent in any five-year period over the last five years.

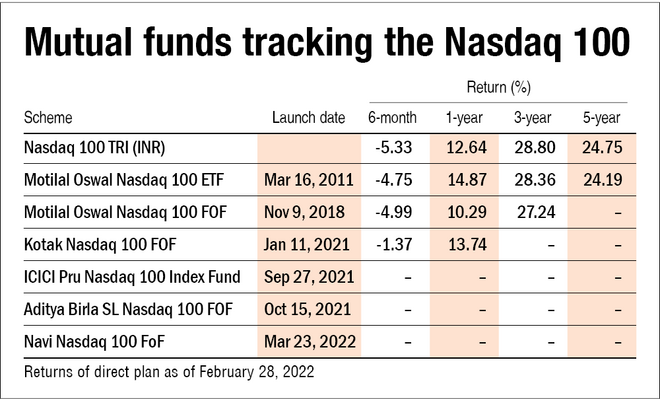

Other funds tracking the Nasdaq 100

Driven by the craze of international investing and particularly in the Nasdaq 100 index owing to its incredible performance in recent years, various fund houses have lined up to fill their product basket by launching their Nasdaq 100 offering in the last two-three years. Here is the detail of all mutual funds that provide exposure to the Nasdaq 100 index:

About the AMC

Invesco is an independent global investment management firm with $1.5 trillion in assets under management around the globe. It employs more than 8,200 employees worldwide with an on-ground presence in 20 countries, serves clients in 120 countries, and is a publicly-traded company on NYSE. It owns Invesco Mutual Fund in India which has an asset base of Rs 42,700 crore, as of March 31, 2022 spread across 11 debt funds, 18 equity funds and four hybrid funds.

Also read: Three questions you should ask before investing in an NFO