How did it come into being?

LIC was formed on January 19, 1956, when the government decided to take over all the 245 life insurers (including foreign ones) operating in India. So, LIC was created with an objective to nationalise life insurance in India, spread insurance widely and effectively mobilise public savings. Here are the key milestones in its journey.

What's embedded value?

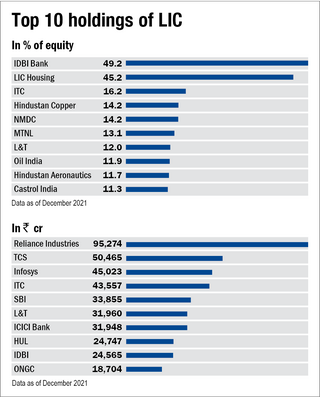

Embedded value is an estimate of the present value of shareholders' interests in the distributable profits from the assets of a life insurance company after paying all life-insurance claims. In other words, it captures the profits that accrue to shareholders from the policies that have already been sold. The valuation of a life insurer is generally quoted as a multiple of the embedded value. Currently, listed peers of LIC are trading at a market-cap-to-embedded-value range of two to four times. LIC's market cap, based on its upper band price Rs 949 per share, is just above Rs 6 lakh crore, which is 1.1 times its embedded value. Going by this, LIC could become the fifth largest listed entity in India behind Reliance Industries, TCS, HDFC Bank, and Infosys. Although it must be remembered that the grey market premium may increase or decrease the market capitalisation of LIC on the listing day.