LIC, the largest life insurer in India, has been in business for more than 65 years. It was formed in 1956 by nationalising and merging 245 private life insurance companies. Until 2000, it was the only life insurer in India by virtue of the ban on private players. LIC accounts for the lion's share of the life insurance market [around 61.6 per cent and 61.4 per cent in terms of gross written premium (GWP) and new business premium (NBP), respectively] as of December 2021. This is due to LIC's monopoly status for more than four decades, a large number of individual agents (especially in rural areas), a wide range of products and a sense of trust created by being Government-owned.

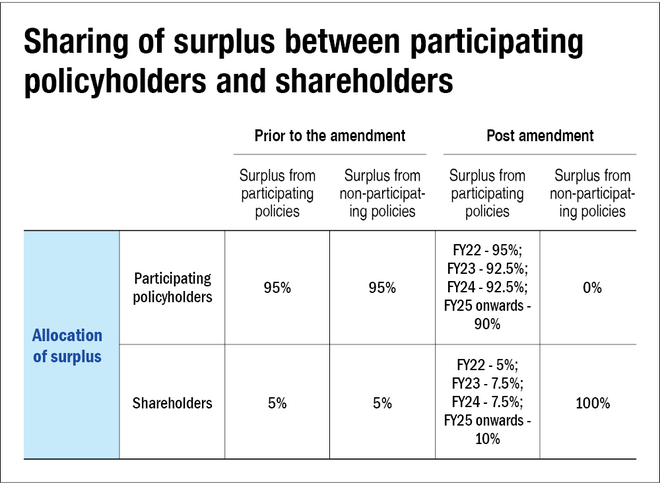

LIC's offerings cover various segments across individual and group products. Its group product portfolio offers 11 products and its individual product portfolio presently comprises 16 participating and 16 non-participating products. Participating products are policies where the policyholder receives a variable amount depending upon the profits of LIC whereas non-participating policyholders only get a fixed payout. It has the largest individual agent network among life insurers in India, comprising 13.3 lakh individual agents as of December 31, 2021. Its 2,048 branch offices and 1,559 satellite offices cover 91 per cent of all districts in India.

The corporation is also the largest asset manager in India with assets under management (AUM) worth Rs 40.1 lakh crore as of December 31, 2021. The size of LIC's AUM is more than 1.1 times the AUM of the entire mutual fund industry in India and 3.2 times the combined AUM of all private life insurers in India. The size of the Indian life insurance industry was Rs 6.2 lakh crore on a total premium basis in FY21. CRISIL Research forecasts the industry's total premium to grow at 14-15 per cent CAGR over the next five years, to reach close to Rs 12.4 lakh crore by FY26.

Strengths

1. The largest player in India: For the nine months ended December 2021 period, LIC's market share was 61.4 per cent based on NBP. Its NBP was 1.6 times that of the total private life insurance sector. For the same period, the market share was 61.6 per cent based on GWP.

2. Trusted brand: As LIC was the only life insurer in India till 2000, its name has become synonymous with life insurance. It has been recognised as the second most valuable brand in India for the years 2018, 2019 and 2020 by WPP Kantar.

3. Low operating costs: LIC incurs low operating expenses and total costs in comparison to the industry. It had an operating expense ratio of 8.7 per cent in FY21, as against a median of the top-five private players of 11.9 per cent. Similarly, its total cost ratio (commission and operating expense) stood at 14.2 per cent in FY21 and the median for the top-five private players was 16.3 per cent.

4. Vast and productive agent network: LIC's agent network is wider than the entire private life insurers' agent network in India. As of December 31, 2021, its individual agent network accounted for 55 per cent of the total agent network in India. Further, LIC also had the highest agent productivity both by premiums (approx. Rs 4,13,000 per agent in FY21) and the number of policies (15.3 policies on average in FY21).

Risks/weaknesses

1. Exposure to the pandemic: As LIC's policies are primarily distributed by individual agents, any lockdown could result in the company not being able to undertake the desired amount of business. Due to the first and second COVID waves, the number of active individual agents decreased by 3.6 per cent between March 2021 and December 2021. Moreover, as the pandemic caused a deferral of exams by IRDAI for individual and corporate agents, the company was not able to hire as many new agents as it would have liked. LIC also incurred higher claims as its claims ratio increased from 42.6 per cent in FY20 to 46.7 per cent in FY21 and further to 52.7 per cent in 9M FY22.

2. Reduced attractiveness of LIC policies: A recent amendment to the LIC Act has reduced the amount of payouts to participating policyholders so that shareholders can enjoy higher returns. In fact, LIC's embedded value (which is the present value of all future profits) jumped more than five times from Rs 95,605 crore to Rs 5,39,686 crore after the amendment. While this is beneficial to shareholders, the lower payouts could reduce the attractiveness of LIC's participating policies (which constitute more than 60 per cent of LIC's GWP in 2021) relative to other competitors.

3. High and increasing competition: The primary competitors of LIC are private life insurance companies which have been growing faster than LIC and have been steadily gaining market share. Between FY16-FY21, the total premium for private life insurers grew at a CAGR of 18 per cent while the growth for LIC was 9 per cent.

4. The adverse impact of incorrect assumptions: A life insurance product is priced based on many assumptions and estimates regarding future claim payments, mortality, risk assessment, interest rates, future investment returns etc. These assumptions are not set in stone and require careful due diligence by managers and actuaries. If the reality deviates significantly from these assumptions, then the future obligations could have a material impact on the company.

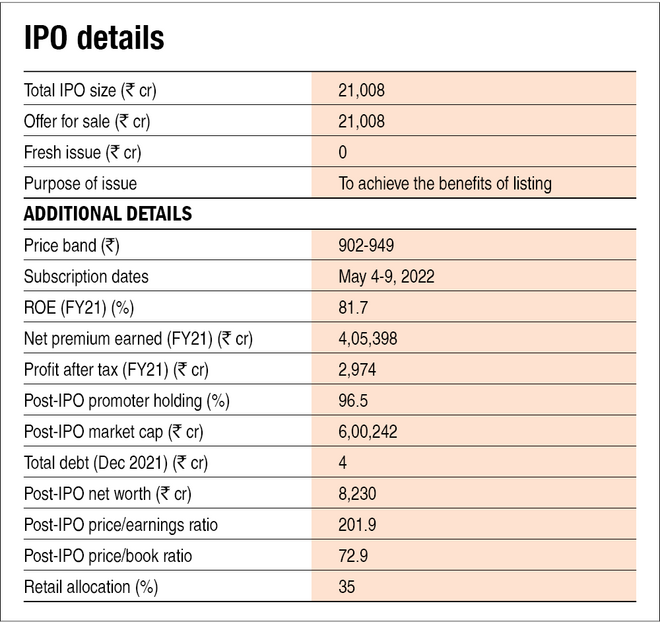

Also read about LIC IPO: How good is it? to learn how we evaluate LIC on various metrics.

Disclaimer: The authors may be an applicant in this Initial Public Offering.