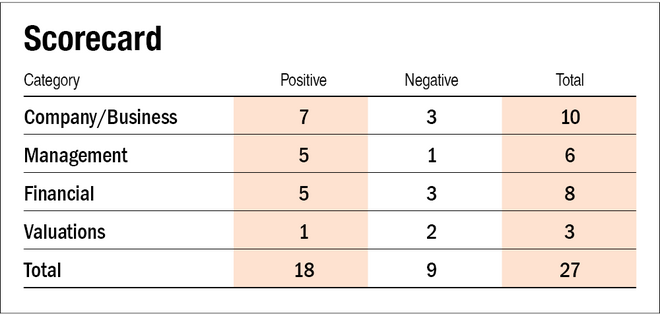

In our previous part of the LIC IPO story, we elaborated on the critical details of the IPO and important information about the company. Here we will answer some questions about LIC and evaluate it on parameters like management, financials, valuations, etc.

IPO questions

The company/business

1) Are the company's earnings before tax more than Rs 50 crore in the last 12 months?

Yes. The company's profit before tax was Rs 2,980 crore in FY21.

2) Will LIC be able to scale up its business?

Yes. Low insurance penetration in India and LIC's strong foothold across the country would help it scale up its business.

3) Does the company have recognisable brands truly valued by its customers?

Yes. LIC brand is synonymous with life insurance in India.

4) Does LIC have high repeat customer usage?

Yes. The company's persistency ratio (a measure representing the percentage of policyholders who continue to pay their renewal premium) stood at 88 per cent for the 13th month, 80 per cent for the 59th month and 79 per cent for the 61st month as of December 31, 2021.

5) Does the company have a credible moat?

No. While the company's strong brand recognition, vast scale and decades of underwriting experience offer it a great advantage, it has been losing out to private competitors.

6) Is the company sufficiently robust to major regulatory or geopolitical risks?

Yes. The company is sufficiently robust to significant regulatory or geopolitical risks.

7) Is the company's business immune from easy replication by new players?

No. While there is a high cost of capital to start an insurance company, there are many players in the industry, and regulatory norms don't put a cap on the number of insurers. But, it would be difficult for any new entrant to become profitable.

8) Can the company's product withstand being easily substituted or outdated?

Yes. There is no substitute for life insurance.

9) Are the customers of the company devoid of significant bargaining power?

Yes. LIC solely determines the price of its products.

10) Are the suppliers of LIC devoid of significant bargaining power?

Not applicable. There are no suppliers in the life insurance industry.

11) Is the level of competition the company faces relatively low?

No. The company operates in a highly competitive space with 23 private players.

Management

12) Do any of the company's founders still hold at least a 5 per cent stake in the company? Or do promoters hold more than a 25 per cent stake in the company?

Yes. Post-IPO, the promoter will hold about a 96.5 per cent stake in the company.

13) Do the top three managers have more than 15 years of combined leadership at the company?

Yes, the three managers have been with the company since 1984.

14) Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes, we have no reason to believe otherwise.

15) Is the company free of litigation in court or with the regulator that casts doubts on the management's intention?

No, there are material outstanding legal proceedings involving LIC and one of its foreign subsidiaries. The aggregate amount of these litigations is around Rs 83,051 crore.

16) Is the company's accounting policy stable?

Yes, the company's accounting policy is stable.

17) Is the company free of promoter pledging of its shares?

Yes. The company's shares are free of any pledge.

Financials

18) Did the company generate a current and three-year average return on equity of more than 15 per cent and a return on capital employed of more than 18 per cent?

No, the company managed to generate a three-year (FY19-21) average return on equity of 289.6 per cent and a return on capital employed of 1.4 per cent. For FY21, the company generated a return on equity of 81.7 per cent and a return on capital employed of 2.3 per cent. Note that the high RoE was due to the unique circumstances of LIC, which artificially kept the equity low and thereby pushing the RoE optically high numbers. This may not be the case in the future.

19) Was the company's operating cash flow positive during the last three years?

Yes, the company has reported positive operating cash flow during the last three years.

20) Did LIC increase its net premium earned by 10 per cent CAGR in the last three years?

No. The company's net premium earned increased from Rs 3,39,972 crore in FY19 to Rs 4,05,398 crore in FY21 at a CAGR of 9.2 per cent.

21) Is the company's net debt-to-equity ratio less than one, or is its interest-coverage ratio more than two?

Yes. The company is net-debt free.

22) Is the company free from reliance on huge working capital for day-to-day affairs?

Yes. LIC does not need any working capital. As an insurance company, it collects premiums upfront and makes payouts in the future and therefore has access to a pool of money - informally referred to as "float".

23) Can the company run its business without relying on external funding in the next three years?

Yes. The company is well-capitalised and not in need of external funding. Its solvency ratio was 1.77 times in December 2021 against the IRDAI mandated 1.5 times.

24) Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes. The company does not have any short-term borrowings.

25) Is the company free from meaningful contingent liabilities?

No. There are contingent liabilities of Rs 29,407 crore as of December 31, 2021. This is equivalent to 357 per cent of net worth.

Stock/valuations

26) Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No. The operating earnings yield for LIC is about 0.5 per cent. However, note that the concept of operating earnings is not similar to the one for non-banking, financial services and insurance companies.

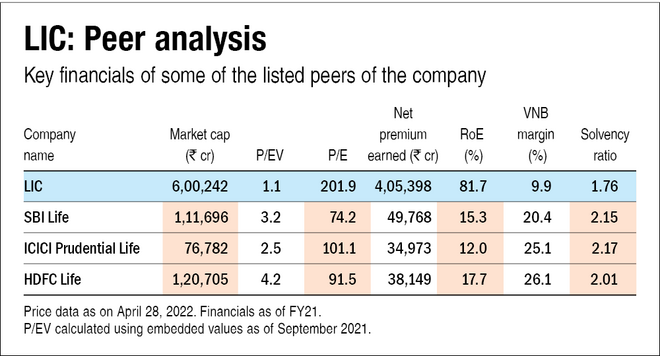

27) Is the stock's price-to-earnings less than its peers' median level?

No. Post-IPO, the company's stock will trade at a P/E of around 201.9, which is more than its peers' median P/E of 91.5.

28) Is the stock's price-to-embedded value (P/EV) less than its peers' average level?

Yes. Post-IPO, the company's stock will trade at a P/EV of around 1.1, less than its peers' average P/EV of 3.3. The embedded value estimates the present value of shareholders' interests in the distributable profits from the assets of a life insurance company after paying all life insurance claims. In other words, it captures the profits that accrue to shareholders from the policies that have already been sold.

Also, read our earlier story on LIC IPO to learn about crucial IPO details and important company information.

Disclaimer: The authors may be an applicant in this Initial Public Offering.