The interest earned or accrued on a National Savings Certificate (NSC) is taxable. For taxation purposes, it should be added to the taxable income of the investor every year (not just at the time of maturity) and taxed as per the applicable slab. One must show it under the head, 'Income from other sources' while filing their tax return.

However, the interest accrued on NSC is automatically reinvested and added to the principal (original investment) every year. And the same can be claimed as a deduction from taxable income under section 80C of the income-tax act. But one must remember that the benefit of section 80C is limited only up to a maximum of Rs 1.5 lakh.

Further, since the NSC has a tenure of five years, while the interest accrued on the first four years would be reinvested automatically and can be claimed as a deduction, the interest for the fifth year will be paid-out to the investor along with the maturity amount. This will remain taxable as it doesn't get reinvested.

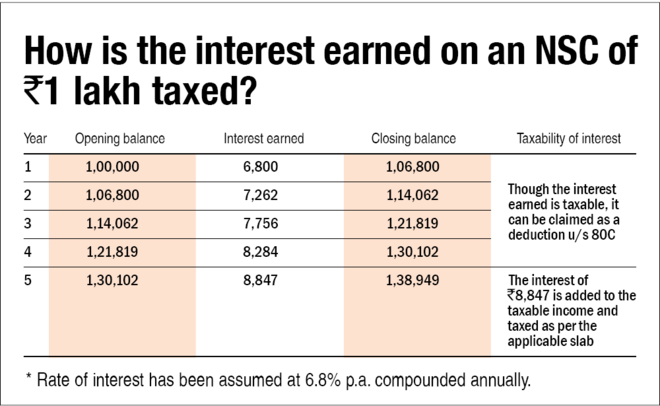

Let's understand this with the help of an example. Suppose you invest Rs 1 lakh in an NSC with an annual return of 6.8 per cent. At the end of the 1st year, the accrued interest would be Rs 6,800 which will get reinvested automatically. Now, your principal at the beginning of the 2nd year would increase from Rs 1 lakh to Rs 1.7 lakh. Though this interest of Rs 6,800 is taxable, it can be claimed as a deduction u/s 80C as it is reinvested in NSC. The same can be done for the 2nd, 3rd and the 4th year. But at the end of the 5th year, when the NSC matures, the interest accrued (Rs 8,847) for the 5th year cannot be reinvested and is rather paid out. This remains taxable and cannot be claimed as a deduction.

Suggested read: An overview of 6 popular tax-saving options