With restrictions imposed on overseas investments through mutual funds, many investors are turning to the direct routes of buying foreign stocks with the help of the Liberalised Remittance Scheme (LRS). The LRS allows you to transfer money overseas up to $2,50,000 (about Rs 1.9 crore as per the current exchange rate) in a financial year. Leveraging the scheme, Indian investors are increasingly connecting to foreign brokers directly or to Indian brokers having tie-ups with foreign brokers in order to invest overseas. Keeping up with the trend, new channels, 'NSE IFSC' and 'India INX Global Access,' have also emerged as a platform to invest abroad. These two channels are the fully-owned subsidiaries of NSE and BSE, respectively, in GIFT city, Gujarat.

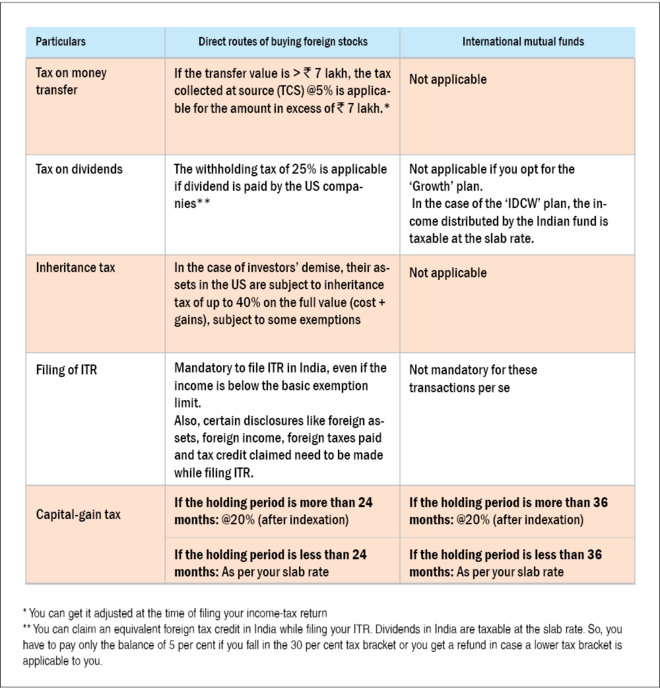

However, unlike mutual funds, using the LRS route to invest overseas amounts to investing directly in foreign stocks. You should, therefore, be conversant with the laws of the country you are investing in, as well as the Indian rules applicable for such transactions. The following are some of the noteworthy regulations that you should be aware of before investing: