Multibaggers, high compounders, superior wealth creators - you can use whatever phrase you like, but the search for a set of companies that have the potential to make an investor vastly wealthy (or even moderately) is a common theme across all sorts of investors. But where does one look? We know that small-cap and mid-cap companies grow faster than large-cap companies. However, large-cap companies are more resilient to changing environments. Small-cap and mid-cap companies are more prone to succumbing to external as well as internal shocks. So, how does one balance it out?

In this story, we want to present a starting point for potential wealth creators. We ran through the numbers and found some interesting tidbits. Before we delve into the details, let's understand the process undertaken.

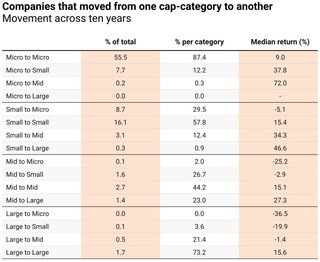

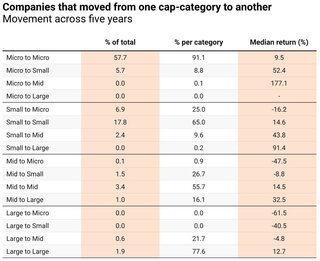

- We categorised all companies under the various capitalisation categories (Micro, Small, Mid and Large) for each year since 2000 (March-end).

- Then we calculated the returns over a 10Y and a 5Y horizon starting from March 2000. Thus, we had 13 data points for the 10Y horizon (e.g., March 2000 to March 2010, March 2001 to March 2011, and so on till March 2012 to March 2022) and similarly, 18 data points for the 5Y horizon (e.g., March 2000 to March 2005 till March 2017 to March 2022).

- We also kept track of the movement across capitalisation categories.

The following tables present the median result of this for both the 10Y horizon and the 5Y horizon.

Heads:

- % of total - represents the median percentage of stocks (from all stocks) moving from one cap category to another.

- % per category - represents the median percentage of stocks (within a cap category) moving from one cap category to another.

Insights:

- While the highest return has been offered by Micro to Mid, the number of companies in this category is abysmally low. Thus, the probability of success is very low here.

- Looking at the '% per category' column, we find that, over both five and 10 years, Mid to Large has been fertile ground. That is, mid-cap companies generally present a higher probability of finding multibaggers.

- The next best alternative is the Small to Mid category. However, the small number of companies that go on to become mid-cap presents a slew of dangers.

- Over 10 years, the Large to Large category has generated a fairly decent return with a higher probability of success.

What you shouldn't take away from this analysis

- Just because Mid to Large presents a higher probability of success with great returns, it is not the case that you should shun small-cap or large-cap companies.

- Wealth creation potential is not judged by the company becoming a large-cap company at some point in the future. It is based on business fundamentals, scalability, strong operating and capital allocation skills of the management and other things.

- A portfolio of entirely small-cap or entirely mid-cap companies is unwise. Diversification is required to ensure you don't lose what you have for what you don't need.

Suggested read: Only two sectors gave positive returns in the last three months!