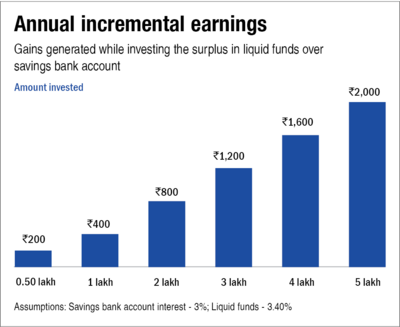

Within several types of debt mutual fund schemes, liquid funds are a suitable avenue to park your money for your immediate needs that are due over the next few weeks or months. They have the potential to return slightly higher than the savings bank account. We often come across the question that whether retail investors should use their savings bank account or liquid funds for that purpose to gain more returns. Let us compare both.

Liquid funds are debt funds that invest in instruments having a maturity period of less than 91 days. As the name suggests, these funds invest in highly liquid instruments. They are suitable to park your money for the immediate needs that are over the next few weeks to months. But they have an exit load if redeemed within seven days and they range from 0.0070 per cent on day one to 0.0045 per cent on day seven.

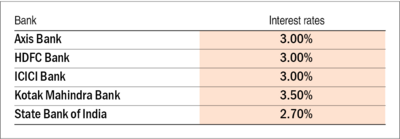

On the other hand, a savings account acts as storage for our money. This is not an investment. But, just keeping cash in the account can help us to make some interest. Some of the top banks provide an interest rate of around 2.70 to 3.50 per cent.

If we take an investment horizon of one year and compare the returns, liquid funds returned 3.41 per cent over the last one year as of May 31, 2022, and the interest from the savings bank accounts was 3 per cent. We can see that there's not much of a difference.

If we take a look at the taxation of both, the interest income from a savings bank account is added to your income and taxed as per the applicable slab. However, section 80TTA allows claiming a deduction of up to Rs 10,000 which looks quite a reasonable amount for a retail investor.

On the other hand, gains from liquid funds (if sold within three years) are added to the income and taxed as per the applicable slab. So savings bank accounts have an upper hand here. However, if you hold your money in liquid funds for more than three years, you are eligible to claim the benefit of indexation and the gains are taxed at 20 per cent. So, for a retail investor, unless you have a huge amount, it doesn't make a difference. But if you have received a huge windfall for any reason, they might make a little sense.

Suggested watch: How safe are liquid funds as an investment option?