A lever is something that we use as an external force to lift something. Similarly, financial leverage means the use of borrowed money as a source of capital for commencement, expansion, or mere running of the business. Since the cost of debt is relatively low compared to the cost of equity, companies prefer to borrow instead of raising share capital as it has the twin benefits of not only preventing dilution of ownership but also amplifying the returns that shareholders get. The degree of leverage that a business takes on also matters a lot. We can take leverage of 2:1 where debt is two times the amount of equity, or 1:1 where debt and equity are equal, or even 4:1 where debt is four times compared to equity.

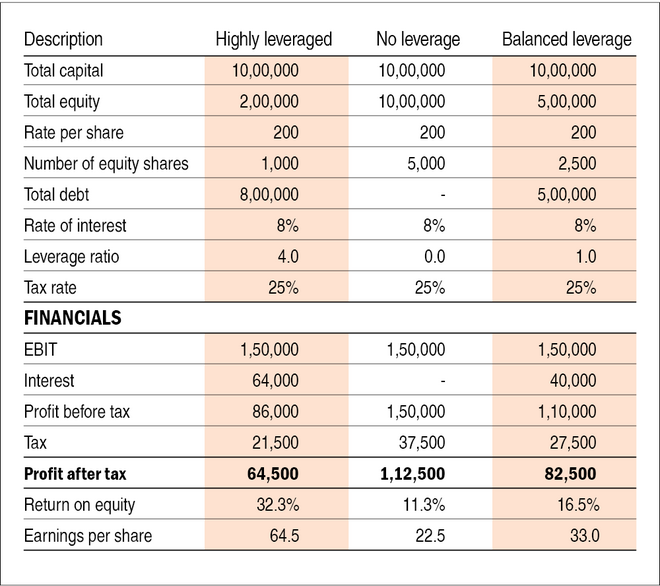

But debt also comes with its fair share of disadvantages. To understand why exactly it is a double-edged sword, let us take an example. Let's say you require Rs 10 lakh to start a project which generates an EBIT (earnings before interest and tax) of Rs 1,50,000 each year. You have two choices: either raise money by issuing equity shares only or raise money through a combination of equity and debt. The choice and the degree of leverage impact our profits, return on equity, and earnings per share. This is the result in three different scenarios:

As we can see, when the project is highly leveraged, the return on equity and earnings per share are the highest, and in the unleveraged business return on equity and earnings per share is the lowest. As we can see in a balanced leverage situation, return on equity and earnings per share are neither the highest nor the lowest.

But why is it a double-edged sword?

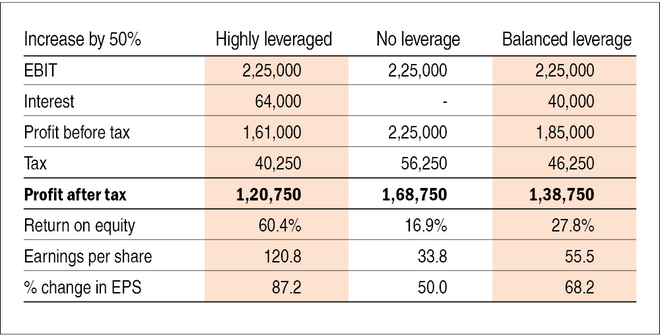

Financial leverage is called a double-edged sword due to the fixed interest cost that it bears. No matter the revenue projection, the interest cost will remain the same. In order to understand this better, let us take two scenarios: one where the EBIT increases by 50 per cent and the other where EBIT decreases by 50 per cent due to wild circumstances.

As we can observe from the table, an increase in revenue projection amplifies the return on equity and earnings per share on a highly leveraged business. At that rate, the investors will be able to recover the Rs 2,00,000 that they invested in less than two years. As leverage decreases, return on equity also decreases at the same amount of revenue.

But if we look at the second scenario, things take a wild turn. When revenue projection falls by 50 per cent, a highly leveraged company is the worst performer while an unleveraged company is the best performer. This is because a good chunk of the company's revenue goes directly to interest costs and investors are left with peanuts.

And this is the reason why financial leverage is called a double-edged sword. Interest costs would remain the same irrespective of the change in revenue. While an increase in revenue projection would be a boon for the investors, a decrease in revenue would be a bane for the investors as they will have to pay the same amount of interest.

So is leverage good or bad?

The answer completely depends on the degree of leverage that a company takes and at what time it takes. In a high-demand scenario where the company expects its revenue would jump multiple times with an expansion, leverage will help them since they can employ additional capital at a relatively lower cost and amplify the shareholder returns. In a low-demand scenario where the company expects its revenue to not increase anywhere due to various macroeconomic factors, it would be better not to take a high degree of leverage since there is no tangible opportunity for growth. It is always important that the company should take up debt only to that level it can handle and not beyond that.

Suggested read: