Know your customer or KYC is a process used to identify the customer. KYC is a prerequisite to investing in mutual funds. It is a basic requirement that needs to be fulfilled for investing in mutual funds. KYC is a one-time process and is valid across mutual fund companies. So even if you're investing across two to three fund houses, going through the process once is enough. Here are some of the documents that are generally needed.

- Recent passport size photograph

- Copy of PAN card

- Aadhar card for proof of identity and address

If you're not sure whether you're KYC complied, you can check the status by visiting any of the links below.

- https://www.cvlkra.com/

- https://www.nsekra.com/

- https://camskra.com/

- https://www.karvykra.com/

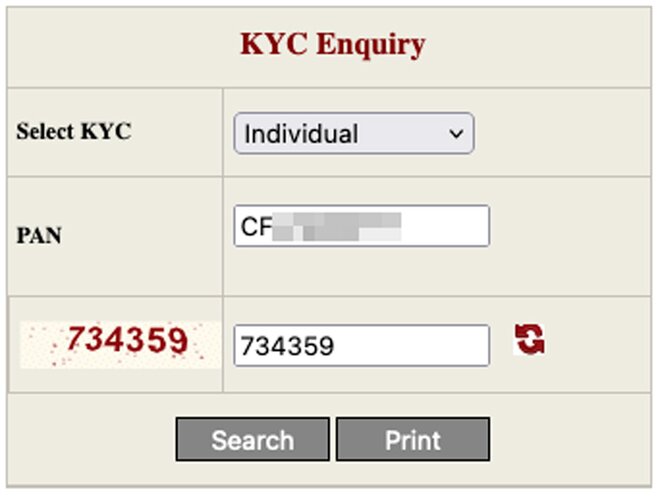

You can check your KYC status from the above websites. You only require your PAN card to log in. For example, you can visit NSE's website

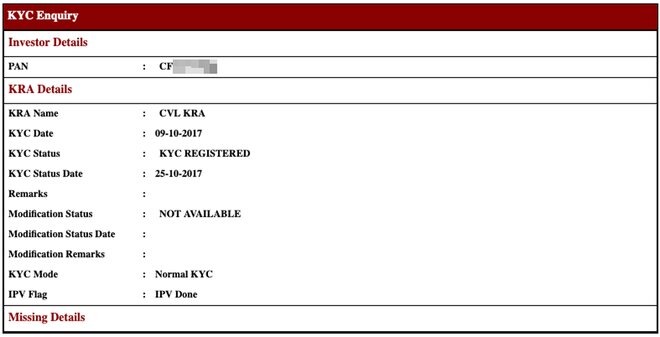

Once the search is complete, a pop-up will appear such as the one below. You get details such as the name of KYC Registration Agency and the date of application. If you're KYC compliant, it shows as KYC Registered.

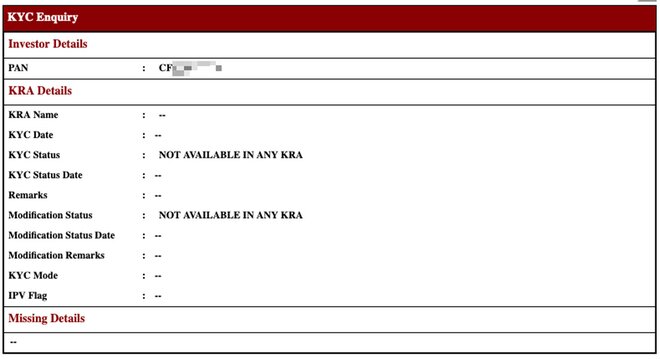

If your KYC process is not complete. It shows up like this.

If you're not KYC compliant, there's no need to be disheartened. It is an easy process and doesn't take much time. Many fund houses and KYC Registration Agency (KRA) facilitate the process online. A KRA is a centralised storage of the KYC records. This KYC information can be accessed by all the SEBI Registered Intermediaries.

These days, you can easily get your KYC process done online without you having to go anywhere. For example, as provided on the website of UTI Mutual Fund, one just needs a soft copy of their PAN and Aadhaar along with a cancelled cheque with your name printed on it, and a scanned copy of your signature on a plain white paper. In addition, you may be required to go through a video call for in-person verification and provide an OTP that is sent to the mobile number registered /linked with your Aadhaar.

Alternatively, you can visit the nearest branch of any fund house, KRA, or take the help of any mutual fund distributor to help you complete the paperwork.