SIP, STP, SWP...it seems the world of finance is conspiring against you and making your mutual fund journey complicated. Don't worry though, give this article a quick read and you'd realise that not only are they very simple to understand, they actually improve your investing strategy.

So, let's not waste any more time and dive straight in.

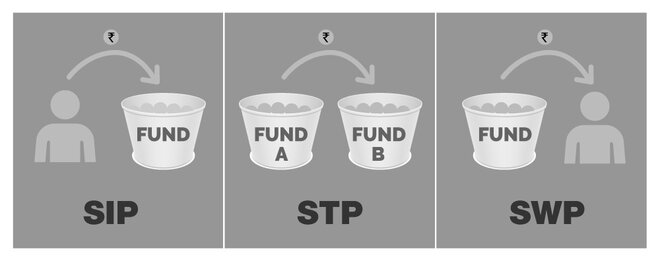

1. Systematic Investment Plan (SIP)

SIP allows you to invest a fixed amount of money in a mutual fund at regular intervals. Let's say you want to invest a certain amount in an equity mutual fund every month, SIP helps you do that.

In fact, you can start your SIPs for as low as Rs 500.

You may think, "How can small amounts of money help me build wealth?" SIPs can do that due to the power of compounding. It brings together the powerful forces of money and time to help you grow your wealth in the long run.

But that's not to say you can't invest large amounts. It all depends on your income and financial goals.

Also, most people, despite knowing the importance of equity investing for wealth creation, keep sitting on the sidelines. They often cite reasons like, "the equity markets are too high", "the equity markets are down in the dumps'' or "the equity markets are going nowhere".

This is where SIP comes into play. It helps you stay invested through the ups and downs of the market. Here, you simply invest a fixed amount on a monthly basis irrespective of what is happening in the stock market. For example, you can instruct the fund house to invest say Rs 10,000 on the 10th of every month for the next 60 months in a specific fund. This way, you can keep investing in the best mutual funds for long-term growth.

How is this helpful? By spreading out investments over a period of time, you can average the purchase cost and stop from committing all your money when the market is expensive. This is why SIP scores over lumpsum investment, i.e., putting all your money in one shot.

2. Systematic Withdrawal Plan (SWP)

SWP is the exact reverse of an SIP.

In SWP, a specific sum of money can be automatically withdrawn from your mutual fund investments at a specified time and credited to your bank account.

SWP can be a very effective strategy in two scenarios: One, it helps you average your withdrawal. This ensures that you don't sell your entire mutual fund investment when the market is down.

Second, SWP can be a secondary source of income. It can be especially helpful for those who have retired. The systematic withdrawal of your mutual fund investment can be helpful in paying for your retirement years.

3. Systematic Transfer Plan (STP)

In an SIP, the instalment amount moves from your bank account to the chosen fund. But in an STP, your money moves from one mutual fund to another.

Let's say you have Rs 10 lakh and you wish to invest the money in equity mutual funds. You have two options in front of you.

One, you can invest the entire amount in one shot - also known as lumpsum. But this strategy is slightly risky because you may be investing at a time when the market is expensive.

Two, you can invest the amount in a debt fund and instruct them to transfer, let's say, Rs 50,000 to an equity fund of your choice on a particular day of the month for the next 20 months. This is how STP works.

You might be wondering why one would go for an STP? Say, you don't want to invest in equity funds in one shot and choose the SIP method. In that case, a large amount of your money would be lying idle in a savings bank account. Since debt funds provide better returns than a normal savings bank account, STP helps you earn a little extra on the lumpsum while it is being systematically invested in your desired equity scheme.

Also, keeping your money safe in a debt fund works better for people who don't have the required discipline and are afraid they'll end up spending the corpus lying in a bank account.

New to investing? Check out our specially curated page for beginners.