Over a decade ago, the Insurance Regulatory and Development Authority of India (IRDAI) introduced the concept of 'portability' in health insurance. This move has enabled customers to shift their health insurance policy from one company to another without losing the benefit of the enhanced coverage that they may have been enjoying. One may wish to port one's policy because of three reasons: a bad experience with the health insurer, better coverage and a lower premium for the same benefits by another insurance company.

Usually, a health insurance policy does not cover the treatment of many medical conditions, like the removal of gall bladder stones, hernias, cataracts, piles and joint replacements in the initial two years. Likewise, the treatment of any pre-existing diseases is generally covered only after a waiting period of three to four years.

Owing to the benefit of the extended coverage, many policyholders are reluctant to change their health-insurance company even when they are not satisfied with their services.

However, on porting, the credit of the period (the number of years) for which the policy has been continuously run is also transferred. So, if you port your policy to a different insurance company, you can still continue to enjoy the benefit of the enhanced coverage. Here is how it works.

- Contact the new insurance company 45 days before the renewal: An insurance policy can be ported only at the time of renewal. While many insurance companies do accept the porting request even a week or 10 days before the date of renewal, it is advisable to start the process 45 days before the renewal date. Just decide on the new plan and the insurance company. Call its helpline number or send an e-mail to express your intent. Some insurance companies also have a dedicated page on their website with a request form.

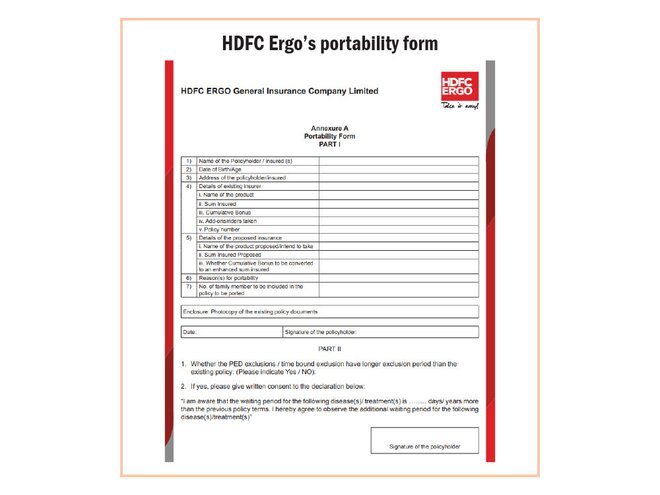

- Fill up the portability request and proposal form: The new insurance company would provide you with a portability request and a proposal form. The portability-request form primarily asks you to submit the details of your existing insurance policy and the details of the new insurer. Also, you need to attach a copy of your existing policy.

Be absolutely truthful while submitting your medical history and other details required. One may think that all these details can be extracted by the insurer from the previous policy and therefore, one need not do the hard work. Although insurance companies do have access to a common database for this purpose, it is not necessary that they will access it. Also, one might have developed certain medical conditions or lifestyle diseases that were not there at the time of buying the old policy and hence not available in the database.

Although you are porting an old policy, you are a new customer for the new insurance company. So, the new insurance company would screen your profile like any other customer before accepting the proposal. It might even ask you to undergo certain medical tests. Hence, all these details are vital and required by the insurer to decide whether it should accept your proposal and provide coverage or not. If you miss stating any material facts here, then it may lead to a claim rejection in the future. So, be careful and do not shy from stating all the facts again.

What all is ported with your policy?

When you port your policy, the following are transferred:

- The credit of the number of years: Terms and conditions of the new policy are binding even if you have ported an old policy. Only the credit of the number of years for which the old policy has been held is transferred. For example, if the waiting period for pre-existing diseases in the new policy is four years and your existing policy is two-year-old, then after porting, you would have to wait for another two years to get the coverage for preexisting diseases.

- No-claim bonus: Insurance companies tend to increase the sum assured by a small percentage after every claim-free year. For example, if you have purchased a health cover of Rs 5 lakh and the insurance company provides a no-claim bonus of 10 per cent after one claim-free year, the sum assured increases to Rs 5.50 lakh.

The new insurance company may or may not agree to provide the coverage on the increased sum assured accumulated as the no-claim bonus. It is at the company's discretion. So, do check with the new insurer on the same. - A higher sum: If you are opting for a higher sum with the new insurance company, in most cases, a complete waiting period is required for the incremental sum assured, as per the terms of the new policy. The credit of the number of years is extended only for the amount of the sum assured with the previous insurer.

What if the new insurer rejects your proposal?

The new insurance company may or may not accept your proposal. The company needs to reveal its decision within 15 days. In the case of a rejection, one can continue with one's previous insurance company or try with another insurer. The premium paid to the new company while submitting the form will be refunded.

Can you port from an insurance policy provided by your employer?

Although it is generally advisable to have an independent health cover, many people rely only on the one provided by their employers. The cover provided by the employer ceases as soon as you leave them. And it is not necessary that your new organisation would provide you with health insurance. Moreover, there can be situations where one may not join any other organisation on an immediate basis.

In such a situation, you may migrate your health insurance plan from a group plan (provided by the employer) to an individual plan. However, here you do not have the option to change the insurance company. It can be migrated only to an individual or a floater health plan provided by the same insurance company. But more importantly, you will get enhanced coverage for pre-existing diseases and other medical conditions by claiming the credit for the number of years for which you have held that policy. Just inform your HR about the same as soon as you resign and he/she will guide you in the process, which should not be widely different from the one mentioned above.

Suggested read: Guide to buying health insurance online