Salaried individuals often have a query as to where should they disclose their mutual fund investments while filing the income tax return in ITR-1. Since we are heading towards the deadline for filing the income tax return for the financial year 2021-2022, this query has again become prominent in our mailbox.

Firstly, one doesn't have to pay taxes on their mutual fund investments if they haven't sold them in part or full during the relevant financial year. Even if your investment has appreciated in value, the gains are not taxable until they are realised. Gains from mutual funds are taxed as capital gains only when they are realised, that is, in the financial year when they are redeemed. Additionally, there is no specific requirement to mention the same in ITR-1, which is generally used while filing the income tax return by salaried individuals.

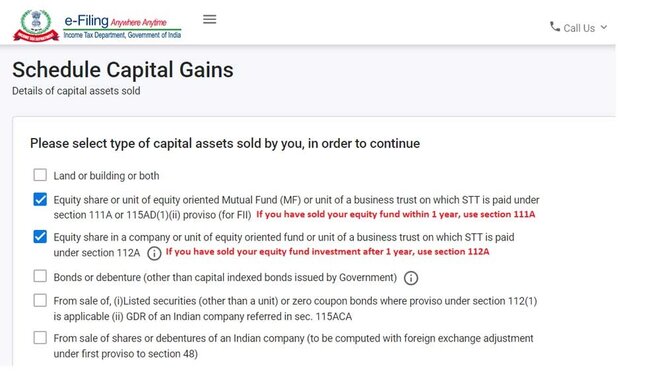

However, if you have redeemed your investment in mutual funds during the financial year 2021-2022, you cannot file your ITR using the form ITR-1. You will now have to file it using form ITR-2. Anyone who has income through capital gains during the financial year must use ITR 2 for filing their income tax return. It has specific sections for you to enter the details regarding the realised capital gains on your mutual fund investments-whether you realised gains on selling equity funds, debt funds, and so on, and whether the gains were short-term or long-term in nature as the taxation differs for both.

Don't worry! You won't have to manually calculate them. A consolidated capital gains statement can be downloaded from CAMS across your mutual fund investments serviced by them. You just have to enter your registered e-mail id. Alternatively, you can separately check with each fund house by logging in to your digital account or calling their helpline.

Further, filing your income tax return is now not as difficult as it used to be. The government has improvised the interface a lot. Most of your details are fetched automatically using your PAN. But still, here is a step-by-step guide to filing your ITR-2 online

Suggested read: Mutual fund redemption and taxation