Apple is the largest holding of Berkshire Hathaway. As of March 31, 2022, the company represented nearly 40 per cent of Berkshire's equity portfolio. Buffett has earned returns of more than four times on his investment of about $31 billion.

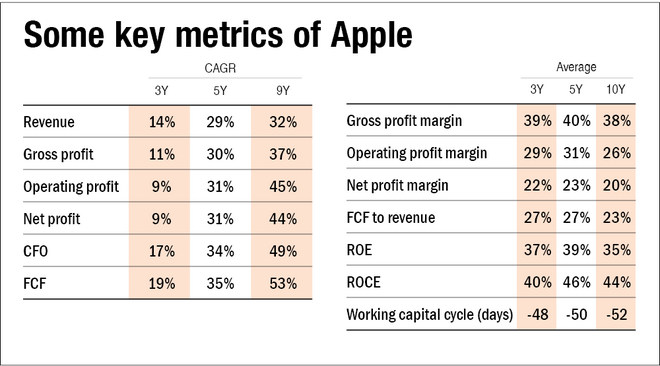

The following table has some data points on Apple. The numbers are as of the fiscal 2015 end. This is what Buffett would have seen in 2016 (when he started buying).

The growth rates and ratios are phenomenal. This is true of any year since Apple launched the first iPhone. And this begs the question: Buffett would have known about these numbers prior to 2016 as well, then why did he choose to invest in 2016 and not before?

It is not as if the company was hidden from mainstream media. In fact, Buffett has been asked about Apple on more than one occasion (prior to 2016). Also, given his aversion to technology-oriented companies, it was a surprise for Buffett-followers that he had placed a huge bet on the company. So what changed?

You'll need to recall two Buffett quotes for this:

What does 'understand' really mean? It doesn't mean only knowing what products and services are offered by Apple. It also doesn't mean that you have to know each and every component that goes into making an iPhone. Understanding a company means that you have the ability to judge (with confidence) where the company will be in five or 10 years' time. This would include understanding what the company has done right in the past and what it has to keep doing to maintain or improve its position. This does not mean that you extrapolate the past or that you try to quantify everything.

The investing world considers Apple to be a tech company. However, Buffett understood it as a consumer product company. He understood the importance of an iPhone or an iPad to a user and the value of the ecosystem these products have. This ecosystem includes the ability of Apple to charge users for storing data on the cloud, listening to music and paying for the apps.

For the company to command similar mindshare in the future as well, Buffett realised that Apple has to make sure that the replacement products are top-notch as well. He would have judged whether the management is capable of that task. Then there was the fact that Tim Cook (unlike Steve Jobs) understood the advantages of buying back their own shares. Thus, Buffett also saw a smart capital allocator running the show.

Of course, there are many other factors that an investor has to consider. But, 'understanding' a business is the starting point. You will not be an expert on all companies. You have to find companies for which you can develop an understanding on similar lines. Moreover, you have to think independently. Don't let the consensus guide your thoughts.

By understanding the company in this manner, you are also able to reduce risk. Without understanding, you don't know what to expect or anticipate and thus, you take on risks that you didn't think even existed. However, a good understanding of a company helps you visualise where the company is heading and that will help you identify the various risks.

The next time you come across a company with a great set of numbers, don't get swayed by it. Take some time to understand what the company is and what factors have played and will continue to play a critical role in its success.

Suggested read: Words of wisdom and experience