Most endowment plans issued by LIC allow taking a loan. The loan value is usually restricted to 80-90 per cent of the surrender value and the policy is further assigned to the Life Corporation of India (LIC) as collateral. Surrender value is the value that a policyholder would receive if he/she decides to terminate the policy mid-way, before the tenure for which the policy was originally purchased. In other words, it is the value that one would receive on closing his/her policy pre-maturely and depends on the number of years for which the policy has been run as compared to the number of years for which the policy was originally intended to be run.

Surrendering an endowment on a traditional plan is usually possible only after paying the premium continuously for three years. However, this may differ for different policies. On surrendering a policy with an outstanding loan, the outstanding principal and the interest (if any) are deducted from the surrender value.

Likewise, the surrender value differs for each policy depending on its specific terms and conditions. In most policies, it is the higher of the 'guaranteed surrender value' and 'special surrender value'.

Guaranteed surrender value is the amount that is guaranteed to be paid by the insurance company in case you want to surrender the policy. It is generally a certain percentage of total premiums paid excluding the first year premium and additional premiums paid for riders (if any). The percentage may vary depending on the policy term and the policy year at which you are surrendering the policy. But usually, it is 30 per cent of the total premiums paid. For example, you have taken an LIC plan for 20 years, and your annual premium is Rs 50,000. So the guaranteed surrender value after five years would be Rs 60,000 (30 per cent of Rs 2 lakh); the premium of the first year is generally excluded.

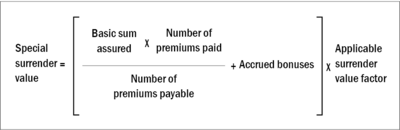

The special surrender value is the non-guaranteed amount which mainly depends on two factors. One is the 'paid-up value' which is the reduced maturity amount or the sum assured in proportion to the total number of years for which the policy has run compared to the original tenure for which the policy was purchased. The second is the 'surrender value factor', an index issued by the insurance company. This again is based on the original tenure of the policy and the year in which it surrendered.

Suppose you paid Rs 50,000 on an annual basis for a sum assured of Rs 10 lakh for a policy tenure of 20 years. You have paid premiums only for five years. Here, suppose the bonus is Rs 30,000 and the value factor is 35 per cent; then paid-up value will be equal to Rs 2.5 lakh and the special surrender value will be equal to {(2.5 lakh+30,000) x (35/100)}, which is Rs 98,000. The surrender value would be Rs 98,000 - higher of the guaranteed and special surrender value.

Now let's say you have a loan outstanding of Rs 10,000. The same would be deducted from Rs 98,000 and the remaining Rs 88,000 would be paid to you.

Suggested read: How to check the surrender value of an LIC policy?