Let's start with the famous "rice and the chessboard story". Once upon a time, there lived a king who was a chess enthusiast. He beat every known player. To motivate his opponents, the king would give any reward that they ask for, provided they were successful in beating the king. One day, he was challenged by a travelling sage to a game of chess. The king obliged and asked the sage to name a prize for himself if he wins.

The sage asked for one grain of rice on the first square of the chessboard. The king got perplexed and asked, "That's it?" The sage continued and said, two grains on the next tile, then four grains on the next, and so on, such that each square has double the amount of the previous one.

The king was baffled, the sage could have asked for any valuable reward he wanted. Nonetheless, he immediately agreed, as to him it looked like a very small prize. The sage was a brilliant player and defeated the king. Having lost the match and being a man of his word, the king called his treasurer to reward the winner. His officials started putting the rice onto the chessboard.

They put one grain on the first square, two grains on the second, four grains on the third, then eight, 16, 32, 64, and so on...The quantity started to look much more than what the king expected to be at the start. It was increasing exponentially with every next tile. By the end of the fourth row, the king needed 2.1 billion grains of rice. He now started becoming anxious and asked his officials to estimate the total rice needed to reward the sage. The answer made him realise that the number of grains required was far beyond the capacity of the chessboard, his palace, and indeed his entire granary!

Wondering how much it was?

Well, the figure came to a whopping 18,446,744,073,709,600,000 (18 quintillion 446 quadrillion 744 trillion 73 billion 709 million and six hundred thousand) grains of rice! It is 2,300 times more than the entire rice production of India in 2021!!! This is called exponential growth or the power of compounding. Mathematically, it can be calculated as two to the power of 64 (2^64).

The same applies to your investments as well because the returns compound over a period of time. For many people, just like the king, this concept of compounding doesn't occur to their mind and they lose as a result. To understand compound interest, let's understand simple interest first. Given an amount of principal, simple interest earns the same amount of interest every year. Whereas compound interest adds on top of the previous year's interest, essentially adding interest over interest. This addition of interest is called compounding.

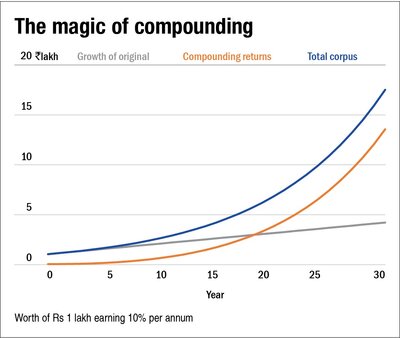

For example, if you invest Rs 1 lakh in an instrument earning 10 per cent per annum, your money will grow to an impressive Rs 17.45 lakh by the end of 30 years. But what's even more interesting is the way your money would grow over these years.

Your money would grow by only Rs 10,000 in the first year. In the following year, you'll earn Rs 11,000. That's 10% per cent on the initial Rs 1 lakh plus 10 per cent on Rs 10,000 earned in the first year. As this pattern repeats, your gains in every subsequent year are higher than the previous year. By the 26th year, the amount you earn in a single year would surpass your initial investment itself. That's how compounding casts its magic over a period.

As you can see, compounding works best when you give it lots of time. That's why you should start investing as early as possible. No matter how small the amount, JUST START!

At the beginning, you might feel like nothing is happening. But after a few years, compounding starts to show its magic and your corpus grows exponentially. Another important element to enjoy is to stay invested in the market no matter how difficult it might get at times of sharp market correction. That's because time and patience are the two most important weapons in your arsenal to take advantage of the power of compounding.

New to investing? Check out our specially curated page for beginners.