Sometimes, we might be in a rush to file our income tax returns at the last minute. We seldom give importance during the initial period and hurry to finish the process when the deadline approaches. It's quite natural to make mistakes when we are rushing things. So what will happen if someone had typed in the wrong details by mistake, while claiming the deduction under section 80C? Would it have any impact?

Section 80C of the Income Tax Act allows claiming certain expenses and investments on actual basis, as a deduction from taxable income. So entering a wrong amount here means that the taxable income calculated for the purpose of the income tax return isn't correct and would thereby also have an impact on the tax liability. So, for example, if your actual deductions under section 80C is Rs 50,000 but you entered Rs 70,000 by mistake, then your taxable income would be reduced by Rs 20,000. This will, thereby, impact your actual taxable liability.

Likewise, it is common to make other mistakes when filing returns. For example, failing to add the interest income earned in the bank account. Or simply, you might have entered some wrong figures and realised them later.

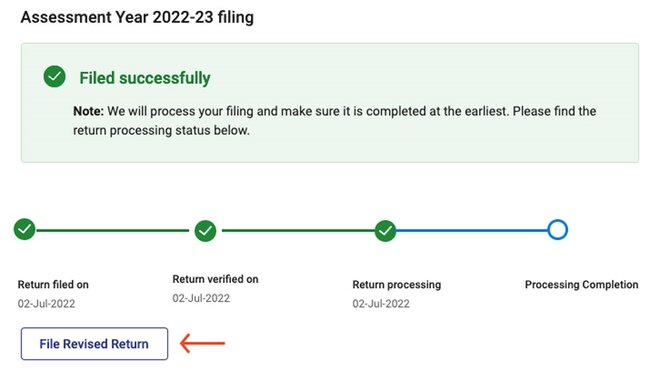

Nevertheless, whatever be the reason, you need not worry. You can still correct it by revising your income tax return. Section 139(5) of the Income Tax Act allows you to revise your income tax return in such a situation. You need to log in to your income tax portal, and on the dashboard select the File Revised Return option.

From here you can file the return for the same assessment year again. Technically, this would mean that you are filing the return again, but this time with corrections. And the income-tax department is likely to process only the revised return once you file the same. However, the revised return can be filed either before your original return has been processed by the department or three months prior to the end of the relevant assessment year, whichever is earlier. For the financial year 2021-22, the relevant date for filing the revised return would be December 31, 2022.

But it is recommended that you rectify this as soon as possible. Just before submitting the return, you get an option to review your return. Take a pause and make sure you go through the complete details that you have filled in so that you avoid making any mistakes.

Suggested read: How to file your ITR