When you sell your assets such as an immovable property/real estate, jewellery, bonds, and non-equity mutual funds among many others, then the gains from that sale are taxed as capital gains. The Income Tax Department allows adjusting the cost of purchase for inflation.

Adjusting the purchase price for inflation is called indexation and helps reduce the tax burden. However, one must note that it is available only if the assets are sold after holding them for a certain specified number of years, which may vary depending on the kind of asset you hold. In the case of immovable property, the benefit of indexation can be availed if it is sold after a period of two years. But for non-equity funds, the indexation benefit can be availed after three years.

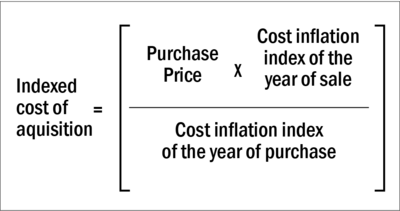

Let us now understand, with the help of an example, how indexation works in the case of non-equity mutual funds. Assuming you have invested Rs 1 lakh in 2001 and the Cost Inflation Index (CII) at that time was 100 and you plan on selling that asset today. The current CII is 317. Your purchase cost will get adjusted to around Rs 3.17 lakh (Rs 1 lakh x 317/100).

Cost Inflation Index (CII) is a metric which is used to calculate the increase in the price of goods due to inflation year by year. You can get this number from the Income Tax India website.

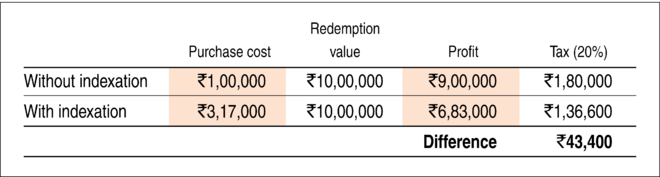

Suppose your investment is now Rs 10 lakh. If you don't adjust your cost for inflation, your capital gains would be Rs 9 lakh and you would have to pay 20 per cent tax on it which comes down to Rs 1.80 lakh. But, if you adjust your initial cost, your capital gains would get reduced to around Rs 6.83 lakh and a 20 per cent tax on it is Rs 1.36 lakh. After applying indexation, you have reduced your tax burden by Rs 43,400. This is how it helps.

Suggested read: