In the previous story, we discussed top-down and bottom-up investing. Here, you will find how to choose between new-age and old-economy companies.

New-age companies are all the rage these days. So, it is appropriate that we address them as well. Let's understand them in comparison with established companies.

Old-economy companies

Technically, the old economy means companies founded during the Industrial Revolution. While such companies still exist and use, more or less, similar production processes (with better technology), they also make use of information technology.

These companies have developed their operations steadily to build a sustainable business. Profitability and cash flows are decision drivers. Scale is not thought of as something to die for but rather something to achieve profitably.

Interestingly, most of these companies didn't think of diluting their ownership to a very large extent. Also, it is not as if these companies are on their last leg. Growth is still very much in their stride. So, it would be unwise to write them off.

New-economy companies

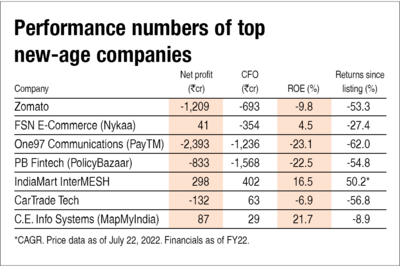

The new economy denotes the shift from a manufacturing-based economy to a service-based economy. Thus, the term denotes the likes of Zomato, PayTM, Nykaa, etc. These companies are service-oriented and most work as a platform connecting buyers and sellers.

The network effect is a commonly used term to describe their business. It means that as more users join the network (the company's website/app), the higher will be the value of that network to the user. For instance, more sellers on Flipkart will attract more buyers, which will attract more sellers and so on.

However, most of these companies are loss-making. Backed by foreign money, their hunger for scale makes them splurge on capturing demand. Instead of developing a profitable niche business and then growing, they are more focused on capturing as much demand as possible.

The usual cry is that they will turn profitable at some point in the future. Don't get lured by it. Ask whether any of these companies actually have a competitive advantage or a barrier to entry. Out of many companies that were the talk of the town during the dot-com bubble in the US, only a handful exist today in any meaningful capacity.

Unless you have a credible understanding or reason to believe that a company would turn profitable and continue to grow profitably, you shouldn't think about investing in it. Don't adjust your selection criteria for these companies. Their constant dependence on outside capital will hurt them, especially in the current higher interest-rate environment.

Unique companies

These are unique in the sense they don't have comparable peers in the listed universe. It is not that they are the only players in the game. A few examples are Tarsons Products (a plastic-labware manufacturer), SJS Enterprises (a manufacturer of decorative aesthetics for the automotive industry) and CDSL (a depository-service provider).

Being the only listed companies in their respective industries doesn't make them winners. You have to perform your analysis. In fact, you have to get a grip on their competitors and that would entail a lot of groundwork.

Conclusion

No matter whether you are considering an old-economy or new-economy company, your criteria for picking companies shouldn't change. Don't get lured by the charm of these new-age companies. They are yet to prove themselves.

Also in the series:

How many stocks should you own?

Which investing style is the best?

What is the right market-cap mix?

How should you research stocks?