In the previous story, we discussed old-economy and new-age companies. This one informs you about investing in government-owned companies.

How should you think about investing in public-sector undertakings (PSUs)? Will they make a good addition to your portfolio?

The bait

PSU stocks almost always look attractive in terms of P/E multiples. They are also backed by the government. So, the government won't let them fail. Look at the number of times the government has recapitalised public-sector banks.

A good number of them pay generous dividends. Out of the 57 companies in the BSE PSU Index, 29 had a dividend-payout ratio of more than 30 per cent, while 19 had a dividend yield of more than 5 per cent (as of July 22, 2022). So, the lure of dividends is also there.

They also have large assets and resources. The sheer size and the market value of the land held by some of these companies are astounding. Then, there is corporate governance. As compared to private companies, the incidences of lapses in corporate governance are fairly low. Last but not least, many PSUs are in strategic sectors, like defence. If you want to bet on such a sector, you would probably have to consider PSUs.

It is true that most won't grow at a high rate but given the cheap valuation and high dividend yields, it appears to be a bargain. Right?

The trap

No. That's the answer to the above question. For all their attractiveness, these companies are rarely a bargain. They simply don't perform on the bourses.

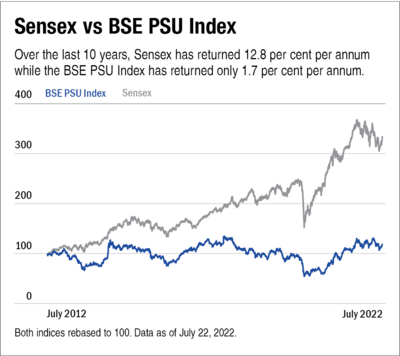

Over the last 10 years, only six out of the 42 companies in the BSE PSU Index (with a 10-year trading history) have outperformed the Sensex. In the last five years, only three out of the 45 companies in the index (with a 5-year trading history) have outperformed the Sensex.

Such poor performance is a common feature of PSU companies. In fact, barring a few, most don't perform well fundamentally as well. Why is that the case?

Why don't PSU companies perform?

When compared to their private counterparts, it seems like management drive is one reason. The fear of losing your job isn't there in the public sector. Besides, the management doesn't have a stake in the business.

Another reason could be incentives. It is not the case that work is not done properly. It is just that there is no incentive to perform better.

Bureaucracy could be another reason. PSUs have various layers of bureaucracy and getting approval for certain projects might take a lot of time. On the other hand, the pace of execution is much faster in the private sector. There could be more reasons but these seem to stand out.

What should you do?

Avoid them. High dividends, which seem attractive, would get annulled by capital losses. Certain PSUs in strategic sectors hold a near-monopoly position. It is a difficult call to make regarding them. Given the history of poor performance, it is best to look for something else. But if you are a savvy investor and know what you are getting into, then perhaps you can add them to your portfolio as a tactical call.

Also in the series:

How many stocks should you own?

Which investing style is the best?

What is the right market-cap mix?

How should you research stocks?

What sort of businesses to prefer?