Many people start thinking about tax-saving investments in the last quarter of the financial year when they are nudged by their employers to submit tax proof. Their mental wiring becomes such that all they want is to dump money somewhere that gives them a tax benefit. And in a rush, most people fall prey to the next sales guy they meet. In this entire process, proper evaluation and suitability of the investment instrument takes a back seat.

To ensure you save tax in the best possible manner, here are three things you should consider:

#1 Tax planning should ideally start at the beginning of the financial year. For investors in India, April is the first month of a financial year. So, the earlier you start, the better it is.

#2 Don't invest your hard-earned money in a tax-saving option blindfolded. Or just because someone recommended you. Understand all the possible tax-saving options and figure out which one suits you best.

#3 Please remember that an ideal tax-saving investment must be a good investment first and a tax-saver later.

Most people invest in Public Provident Fund (PPF), five-year bank fixed deposits (FD) and National Savings Certificate (NSC) because they provide guaranteed returns. But the flip side is that their returns fall short when you factor in inflation.

So, how do you beat inflation? Investing in equity is a good solution.

If you look at historical returns, you'd realise that equity as an asset class has the potential to beat inflation and make you earn real returns.

Therefore, your long-term portfolio should have significant exposure to investments in equity.

If you want a tax-saving investment option that invests in equity and delivers inflation-beating returns, you may consider the following options:

- National Pension Scheme (NPS)

NPS is a good option but comes with a very long lock-in period, typically when you turn 60. Know more about National Pension Scheme (NPS).

- Unit-linked Insurance Plans (ULIPs)

ULIPs are marketed aggressively. But they neither provide adequate insurance nor good returns.

- Tax-saving mutual funds (also known as ELSS)

In our estimate, ELSS scores over both the above options, and suits most individuals as they have a shorter lock-in period, can provide inflation-beating returns and help you save tax.

(You can read about our comparison between ULIPs and ELSS.)

Let's now compare PPF, which is one of the most popular tax-saving options, with ELSS.

PPF vs ELSS

Let's first understand why PPF is as popular a tax-saving investment option as ELSS.

PPF is known to:

- offer tax benefits on contributions as well as withdrawals after the lock-in period

- have government backing

- provide a safe and guaranteed interest income

Naturally, most people get attracted to the guaranteed interest and tax-saving aspect, and invest in this scheme. But they tend to overlook the return aspect.

Equity-linked savings scheme (ELSS) solves the low inflation-adjusted return problem since they invest in equity.

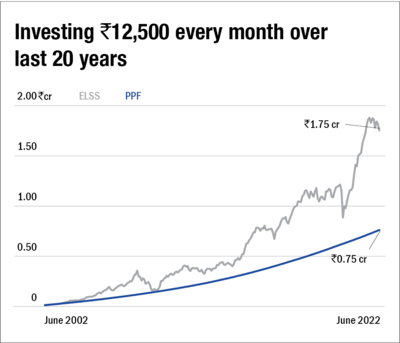

In fact, if we compare the returns of the two, you'd be shocked by the stark difference. Here is an example to help you understand this. Suppose you had invested Rs 12,500 every month for the past 20 years starting June 2002 in an ELSS fund and PPF. This means you would have invested Rs 30 lakh in each of these schemes.

While your PPF investment would have made you Rs 74.5 lakh in June 2022, your ELSS would have delivered a lot more than double that amount. Rs 1.74 crore to be precise. That's a difference of almost Rs 1 crore!

And we aren't even talking about the best tax-saving mutual funds here. Our calculations are based on the category average returns for ELSS and the actual interest rate for PPF for the respective period.

However, gains in your ELSS investment would be taxable. But even then, it would handsomely beat PPF and other fixed-income tax-saving options.

As far as the tax-saving component is concerned, both ELSS and PPF offer a tax deduction of up to Rs 1.5 lakh in a financial year under Section 80C of the Income Tax Act. Put simply, both these options help you save the same amount of tax. However, there is a big gap between their returns potential.

ELSS has another hidden benefit: a 3-year lock-in period, which is shorter compared to other tax-saving options. This lock-in period can be a great way for new investors to taste equity investing without running the risk of pulling out money in panic. Hence, ELSS can not only help you save tax but also build wealth in the long run.

New to investing? Check out our specially curated page for beginners.