Just like any other income, gains made on your investments are taxable and mutual funds are no exception. However, taxation policy can change depending on the type of mutual fund you hold. Similarly, tax consequences change depending on when you decide to sell your mutual fund.

But worry not because this article will help you understand the different tax implications of mutual fund investments.

Tax arises only when you book a profit

Unlike fixed deposits (FD), where the accrued interest is taxed every year, mutual fund gains are taxable only when they are realised, i.e., at the time of redemption. For example, if you invest in an FD for three years and earn Rs 5,000 interest every year, this amount is added to the taxable income of that year even if you do not realise the interest.

However, in case of mutual funds, if the value of your investment increases by Rs 15,000 by the end of the first year and you remain invested, you don't have to pay any tax. Only when you redeem your mutual investment do you need to pay tax.

How tax liability is determined on mutual fund gains?

How much tax you need to pay on your mutual fund gains depends on three factors:

The type of fund you have invested in: From a taxation point of view, mutual funds can either be equity-oriented or non-equity-oriented.

Equity-oriented funds are those that invest at least 65 per cent of your money in equities. The others are termed as non-equity-oriented mutual funds.

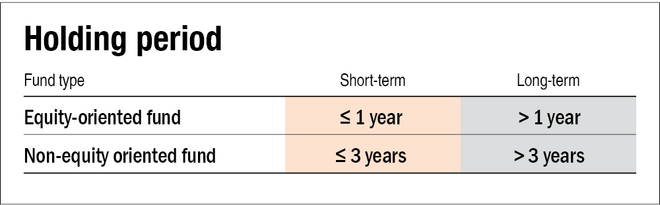

The amount of time you have held on to your mutual fund: Your holding period can either be short-term or long-term. The duration to define this is different for equity-oriented mutual funds and non-equity mutual funds, as explained in the table below:

Your tax slab: This is only applicable if you invest in a non-equity mutual fund. Tax slabs also apply to Income Distribution cum Capital Withdrawal (IDCW) plans of mutual funds too. But more on this later.

Tax implications on equity-oriented funds

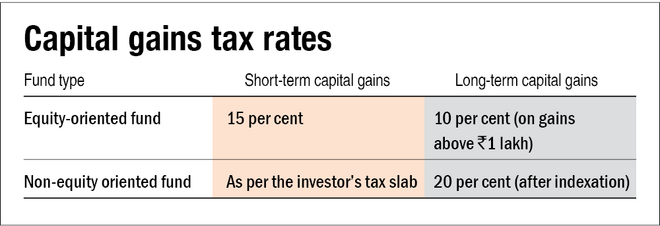

If your holding period is more than a year, the gains are termed as long-term capital gains. In this case, gains up to Rs 1 lakh in a financial year are tax-free, but anything above that is subject to a 10 per cent tax.

If your holding period is less than a year, the gains are termed as short-term capital gains and are taxed at 15 per cent.

Tax implications on non-equity funds

If you invest in a non-equity mutual fund, and your holding period is less than three years, the gains are termed as short-term capital gains and are added to your income. They is taxed as per your income tax slab rate.

If your holding period is longer than three years, then the gains are termed as long-term capital gains and are taxable at 20 per cent after indexation. Understand how indexation works.

The first-in-first-out principle

Another important thing you should know is that the redemption of mutual fund units is based on the first-in-first-out (FIFO) method. That is, the units that you bought first are assumed to be redeemed first.

For example, let's say you bought 100 units of a non-equity fund in September 2017, and 150 units of the same fund again in September 2021. In total, you would have 250 units. Now suppose you wish to sell 120 units in August 2022, here is how your tax liability would look like. For the first 100 units, gains made will be considered as long-term as they were acquired in September 2017, i.e., more than three years ago. And the gains on the remaining 20 units will be treated as short-term as they were purchased less than a year back. So, keep this in mind while evaluating your tax liability.

Tax on income distributed by mutual funds

If you opt for the Income Distribution cum Capital Withdrawal plan (IDCW) of any mutual fund scheme, the fund house might give you some portion of the gains/capital from time to time. Such distributions are added to your total income and taxed as per your income tax slab rates.

Suggested read: Mutual fund redemption and taxation

New to investing? Check out our specially curated page for beginners.