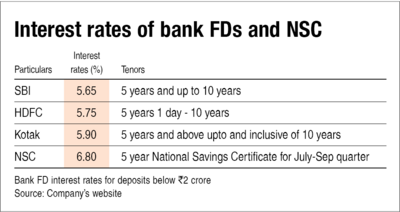

With the Reserve Bank of India hiking repo rates by 140 basis points (1.4 per cent) to tame inflation this year, several lenders have serially raised their fixed deposit (FD) interest rate by 50 to 60 basis points (0.50 per cent to 0.60 per cent) in recent weeks.

While the State Bank of India is offering 6.1 per cent returns - and an additional 0.50 per cent for senior citizens - on their Utsav Deposit Scheme, HDFC Bank has raised their 5- to 10-year FD rates to 5.75 per cent.

Does this mean FD has become an attractive investment option? We don't think so.

That's because the interest you'll earn on your fixed deposit will be taxable.

Here's how your returns will be taxed: The interest you earn each year will be added to your annual income. Only after your total income is added up will your tax slab be determined. So, if you fall in the highest tax bracket, your interest income would be taxed at a whopping 30 per cent.

This is why we believe there are two options better than FD.

Option 1: National Savings Certificate (NSC)

National Savings Certificate is a popular and safe small savings investment option that combines tax savings with guaranteed returns.

This is one of the safest investment options available at post offices because it is backed by the government.

Currently, the interest rate provided by NSC is 6.8 per cent (higher than FD) over a five-year period.

This option is best suited for investors with a five-year time horizon.

As mentioned earlier, NSC is a tax-saving instrument. You can claim up to Rs 1.5 lakh deduction each year as per section 80C of the Income Tax Act. Secondly, the interest you earn in the first four years is also not taxable because the interest amount is reinvested in NSC.

However, the entire income is taxable on maturity (in the 5th year). It will depend on your tax slab rate.

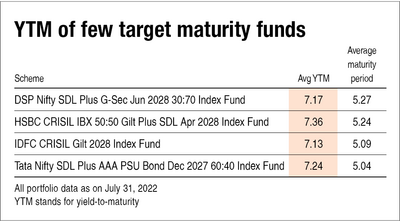

Option 2: Target-maturity funds

TMFs are a rapidly-emerging investment option in the mutual fund industry.

One of the most significant advantages of TMFs is that they offer higher returns than bank FDs.

Target-maturity funds are safe because they only invest in government securities, state-development loans and PSU bonds. Few that invest in corporate bonds restrict themselves to AAA-rated bonds. Given the relatively higher credit-worthiness, there is a fairly low possibility of default.

The returns also have some degree of predictability. Compared to other debt funds, they are not impacted by interest rate movements because they follow a roll-down strategy. The roll-down strategy allows TMFs to stay invested in bonds until maturity. This will enable them to provide close-to-predictable returns.

Although TMFs allow you to withdraw your money before maturity, it is best to not exercise this option if you want predictability in your returns.

Target-maturity funds (TMFs) come with a fixed tenure and at the end of fund life, the money, along with the accumulated gains, is returned to you.

In addition, these funds charge low fees because they aren't managed actively. This can make a huge difference in your overall returns.

The taxation structure is similar to debt funds. TMFs are taxable at 20 per cent after indexation if the holding period is more than three years. If the holding period is less than three years, the interest earned from the investment is added to the taxable income and then taxed as per slab rates.

To sum up

Going forward, FD interest rates are on the rise and can climb even further. But it is better to look at NSC if you are looking for higher returns and better tax efficiency. TMFs, meanwhile, provide even higher returns with certain predictability of how much interest you will earn upon maturity.