What Harsha Engineers does?

Harsha Engineers is India's largest bearing cage manufacturer in the organised space and one of the largest in the world.

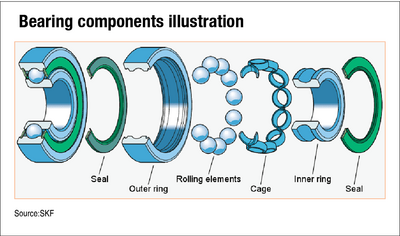

Bearings are one of the most common and important components in various industries such as automobiles, aviation, railways, electronics, and more. Bearing cages are part of a bearing. Since the cost of manufacturing bearing cages is low when compared to bearings (but there's a requirement for separate machines), bearing manufacturers outsource this and that's where Harsha Engineers comes in.

Harsha Engineers manufactures a wide range of bearing cages, such as in brass, steel or polyamide, and from 20mm to 2,000 mm in diameter. The company has two segments: engineering business which contributes 94 per cent in revenue, and solar EPC business which contributes 6 per cent. Harsha Engineers also manufactures brushes and specialty components. It has four manufacturing facilities in total - two in India, one in China, and one in Romania, all of which are strategically located near coasts for easy export. Talking of exports, the company generates 63 per cent of its revenue from exports, with the European region being the major contributor with 60 per cent of total exports revenue.

The international bearing cage market can be a boon for Harsha Engineers

The global bearing cage market is expected to grow at 6.5 per cent per annum from 2021 to 2029, on the back of an increase in the trend of outsourcing. 79 per cent of bearing cages are in-house manufactured and this is expected to change in the coming years. This can be a catalyst for the company's growth.

Strengths:

- Market leader: Harsha Engineers is a market leader in India and one of the largest bearing cage manufacturers in the world. The company holds a 50-60 per cent market share in India and has a global market share of 6.5 per cent. It is the second largest independent bearing cage manufacturer in the world.

- Long-standing relationships: The company has strong relationships with leading bearing manufacturers for years who are also repeat customers. The average age of a relationship with the top five customers is more than a decade.

- Strategic location of facilities: All four of the company's facilities are located near coastal areas for easy transportation. Also, since the products and manufacturing plants have fungibility, so manufacturing can be shifted from one plant to another based on the requirement. Apart from this, Harsha Engineers also has 20 warehouses around the world where inventory is stocked so that they can meet the demand immediately.

Weaknesses:

- Customer concentration: The top five customers not only contribute 71 per cent of revenue but they also have a lot of say in manufacturing. Rates are pre-agreed and they can change the design any time they wish. This puts the company in a difficult position.

- High working capital requirements: The company requires high working capital for day to day operations and currently funds itself through working capital credit. If the company cannot repay these obligations, it may also lose this facility.

- The European power crisis: While this may be a short-term issue, this still poses a threat to the company's Romania plant. That plant is mainly used for manufacturing castings and it contributes to 20 per cent of the company's revenue.

Also read Harsha Engineers IPO: How good is it? to learn how we evaluate the company on various metrics.

Disclaimer: The author may be an applicant in this initial public offering.