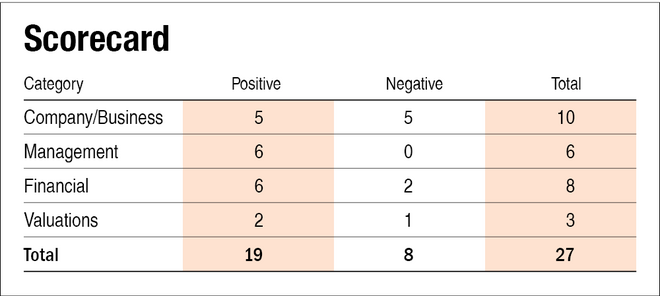

In our previous part of Harsha Engineers IPO story, we read about the key details of the IPO. Here we will answer some questions about Harsha Engineers and evaluate it on parameters like management, financials, valuations, etc.

IPO questions

The company/business

1) Are the company's earnings before tax more than Rs 50 crore in the last 12 months?

Yes. Harsha Engineers' profit before tax for FY22 was Rs 126.6 crore.

2) Will Harsha Engineers be able to scale up its business?

Yes. The company's overall capacity utilisation in each plant is around just 60 per cent and it's also raising money through this issue to fund the purchase of machinery. Thus, it will be able to scale its business quite easily.

3) Does Harsha Engineers have recognisable brands truly valued by its customers?

Not applicable. Since the company is involved in B2B supply of homogeneous products, the concept does not apply. But the repeat customers usage indicates that the company has good impression among its clients.

4) Does Harsha Engineers have high repeat customer usage?

Yes. The company has a strong relationship with its customers and has high repeat customer usage. Its average age of relationship with the top five customers is more than a decade.

5) Does the company have a credible moat?

No. While the company is a leader, it does not possess any moat as there are bigger competitors and bearing companies with in-house manufacturing too.

6) Is the company sufficiently robust to major regulatory or geopolitical risks?

No. Harsha Engineers has two manufacturing plants and various warehouses located around the world. The two manufacturing plants contribute 27 per cent to the total revenue. At present, the company's plant in Romania may face the brunt of power crisis too.

7) Is the business of the company immune to easy replication by new players?

Yes. Manufacturing bearing cage requires a level of precision and technical expertise. Once bearing manufacturers identify one such company, they rarely switch. So it is very difficult for the new players to get the market share.

8) Is the company's product able to withstand being easily substituted or outdated?

Yes. Bearing cages cannot be substituted or outdated as it is an important part of a bearing.

9) Are the customers of Harsha Engineers devoid of significant bargaining power?

No. The top five customers not only contribute 71 per cent to the revenue but they also have the power to change the design whenever required and buy at pre-agreed prices.

10) Are the suppliers of Harsha Engineers devoid of significant bargaining power?

No. The top four raw material suppliers account for 44 per cent of total raw materials consumed and the company does not have any long-term contracts with them too.

11) Is the level of competition the company faces relatively low?

No. The company faces huge competition on a global level, especially from a company called NKC which is the world's largest independent bearing cage manufacturer.

Management

12) Do any of the company's founders still hold at least a 5 per cent stake in the company? Or do promoters hold more than a 25 per cent stake in the company?

Yes. The promoters will continue to hold a 74.6 per cent stake post-issue.

13) Do the top three managers have more than 15 years of combined leadership at the company?

Yes. The company's chairman and whole-time director Rajendra Shah along with managing director Harish Ranwala (both promoters of the company) have been with the company since its inception in 1986.

14) Is the management trustworthy? Is it transparent in its disclosures, which are consistent with SEBI guidelines?

Yes. We have no reason to believe otherwise.

15) Is the company free of litigation in court or with the regulator that casts doubts on the management's intention?

Yes. The company doesn't have any material litigation.

16) Is the company's accounting policy stable?

Yes. We have no reason to believe otherwise. But we would like to mention that the company recently went through a corporate reorganising where Aastha Tools Pvt Ltd (ATPL) and Harsha Engineers (India) Pvt Ltd (HEIPL) merged into Harsha Engineers Ltd (HEL). After that, Harsha Engineers and Helianthus Solar Power Pvt Ltd got merged with the current entity Harsha Engineers International Ltd.

17) Is the company free of promoter pledging of its shares?

Yes. The company's shares are free from pledging.

Financials

18) Did the company generate a current and three-year average return on equity of more than 15 per cent and a return on capital employed of more than 18 per cent?

No. Harsha Engineers' three-year average return on equity (ROE) and return on capital employed (ROCE) are 12.1 per cent and 20.1 per cent respectively. Its current ROE and ROCE are 19.1 and 24.9 per cent respectively.

19) Was the company's operating cash flow positive during the last three years?

Yes. The company posted positive operating cash flow in each of the last three fiscals.

20) Did Harsha Engineers increase its revenue by 10 per cent CAGR in the last three years?

Yes. Its revenue increased by 22.1 per cent CAGR from Rs 886 crore in FY20 to Rs 1,322 crore in FY22.

21) Is the company's net debt-to-equity ratio less than one, or is its interest-coverage ratio more than two?

Yes. The company's net debt-to-equity stood at 0.64 as of FY22 with an interest coverage ratio of 6 times.

22) Is the company free from reliance on huge working capital for day-to-day affairs?

No. The business requires a high level of working capital for day-to-day activities. The company has been dependent on working capital loans to meet its requirements. However, a part of the IPO proceeds will go towards repaying the borrowings.

23) Can the company run its business without relying on external funding in the next three years?

Yes. Harsha Engineers should be able to run its operations with external funding in the next three years as a portion of the IPO proceeds will be used to fund capital expenditure and undertake repair/renovation of existing production facilities.

24) Have the company's short-term borrowings remained stable or declined (not increased by greater than 15 per cent)?

Yes. Its short-term borrowings have increased only by 3.5 per cent per annum from Rs 134 crore in FY20 to Rs 143 crore in FY22.

25) Is the company free from meaningful contingent liabilities?

Yes. The company does not have any meaningful contingent liabilities.

Stock/Valuations

26) Does the stock offer an operating-earnings yield of more than 8 per cent on its enterprise value?

No. The stock offers an operating earnings yield of 4.5 per cent.

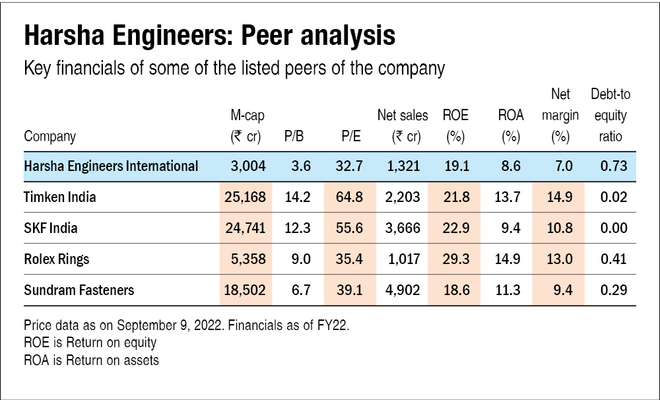

27) Is the stock's price-to-earnings less than its peers' median level?

Yes. Post-IPO, the company's stock will trade at a P/E of around 32.7, which is less than its peers' median P/E of 47.4.

28) Is the stock's price-to-book value less than its peers' average level?

Yes. Post-IPO, the company's stock will trade at a P/B of around 3.6, which is less than its peers' average P/B of 10.5.

Also, read our earlier story on Harsha Engineers IPO to learn about key IPO details and important company information.

Disclaimer: The author may be an applicant in this initial public offering.