If you take any valuation techniques done by analysts or legendary investors, its starting point will not be revenue, profit, or even cash flow from operations. It will always be free cash flow.

But what is free cash flow?

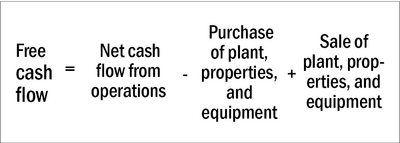

In simple words, free cash flow is the cash that the company still has at the end of the year after incurring capital expenditures. You can arrive at this figure using a formula, and all the components in this formula can be found in the cash flow statement of a company:

Free cash flow is considered a very reliable measure of a business's ability to generate cash from its core operations and shows how much cash a company is left with at its disposal at the end of the year. That is ultimately the objective of any business, irrespective of the scale, i.e., to see the money in their pocket. Many companies either mess up their payables and receivables, which leads to inconsistent cash flow or they invest too much in Capex, which drains the cash generated.

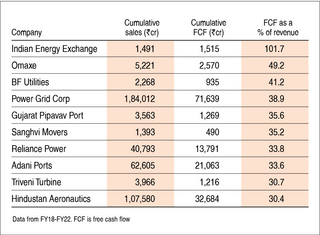

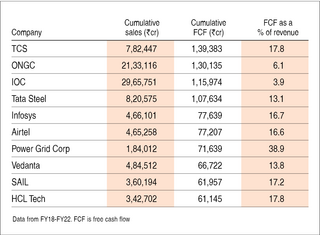

Readers must also be aware that free cash flow must be looked at for multiple years and not a single year. If a company incurs huge Capex in a year, then it will result in a low or even negative free cash flow for the year. So it is better to look at a company's free cash flow for multiple years and even on a cumulative basis.

Here we have given two tables with ten companies each. The first table shows companies that generated the highest cumulative free cash flow in the last five years as a percentage of their cumulative revenue. The other one shows the highest cumulative free cash flow on an absolute basis. All these companies have a market capitalisation of over Rs 1,000 crore and revenue of more than Rs 100 crore every single year.

Suggested read:

Free cash flows: Case study of Titan

Free cash flows: Primary drivers

Free cash flows: Consistent Compounders Portfolio