What is ROCE?

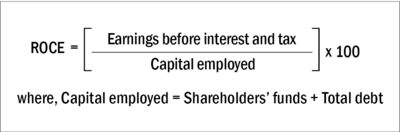

Return on capital employed or ROCE is a basic yet important measure. As the name suggests, the formula computes the return that a company has achieved on the capital it employed during the year. A bit confusing? Well, let's look at the formula:

Now assume that a company is a person and it has some money (which is its capital). So, if a company chooses to invest its capital, it should invest in an avenue where it can get superior returns, right? At least 11 - 12 per cent which is the average returns of Sensex and Nifty in the long run. That is what ROCE is. It shows whether a company has deployed its capital wisely and has earned superior returns on the investment.

An analysis

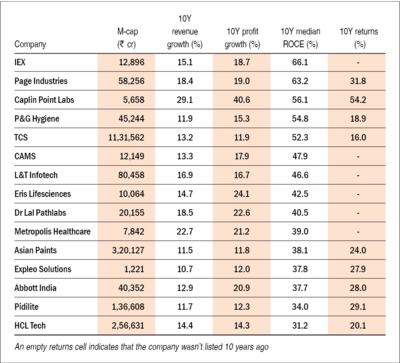

Now we were curious about which companies have been really good. So we did an analysis - companies that have earned more than 25 per cent ROCE every single year for the last 10 years. We also added three more filters:

- Current market capitalisation of more than Rs 1,000 crore,

- 10-year revenue growth of more than 10 per cent, and

- 10-year profit growth of more than 10 per cent.

After applying all these filters, we arrived at 15 companies and the returns that they generated during the period. As you can see in the table, some return cells may be empty as those companies weren't listed 10 years ago.

Let's say you invested Rs 1,000 in all of these companies 10 years ago, which means a total investment of Rs 9,000 (only in the listed ones). At the end of 10 years, you will have Rs 1,53,439, i.e., 32.8 per cent annual returns!

Yes, we got 10 year data even for companies that weren't listed. How? Because we have Value Research Stock Advisor. By subscribing, you will get not only stock recommendations but also ten-year financials for all the companies (given that they existed for 10 years).

Suggested read:

Returns up, but P/E...down?

Free cash flow kings