How high was your heart rate watching the India-Pakistan match in the ongoing T20 World Cup last week?

As we sat stunned watching Virat Kohli pull off an improbable run chase that day, it made us sit up and think how different T20's dynamism is from the rather sobering universe of investing.

While T20's slam-bam style can be likened to trading in the stock market where fortunes swing every minute, history actually shows that cricket's core is not very different from investing.

Look at any World Cup-winning team of the past - be it one-dayers or T20s - you'll realise they are built over a painstakingly long and slow process, much like investing.

One big example is how the seeds of India's 2011 World Cup-winning squad were sown back in the early 2000s with the emergence of Yuvraj Singh, Zaheer Khan, Virender Sehwag, among others.

In much the same way is a successful mutual fund portfolio built. It takes years of patience, discipline and nurturing. You just can't start investing in random mutual funds, or keep flipping them over. Just like in cricket, you need to get the combination right and persevere with it.

So, let's look at how you can assemble a match(life)-winning mutual fund combination to improve your financial stability and security.

Getting the right combination

The Dependables

Virat Kohli, Rohit Sharma, Jasprit Bumrah = Large-caps & flexi-caps

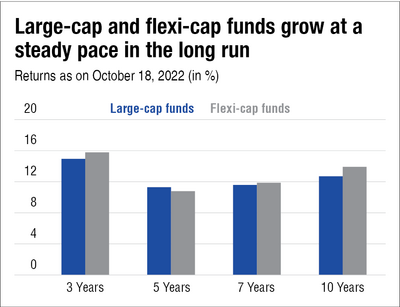

Let's focus on the Indian cricket team. Just like Virat Kohli and Rohit Sharma are expected to score the bulk of the runs and Jasprit Bumrah to spearhead India's bowling attack, large-cap funds and flexi-cap funds should be the mainstay of your portfolio. A bulk of the money should be invested in them.

Just like the Mr Dependables of the Indian cricket team, these mutual funds can help you build wealth in the long run, as seen in the table below.

The Excitables

Dinesh Karthik and Hardik Pandya = Mid- & small-cap funds

The duo's end-overs butchery will set your pulse racing, and be the difference between an average and a match-winning score.

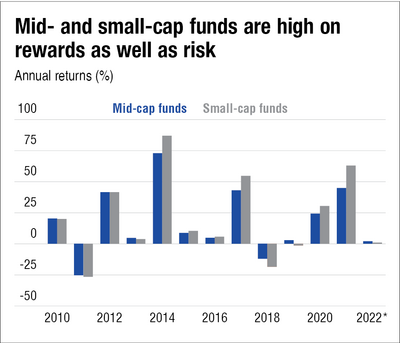

Similarly, mid- and small-cap funds can be the X-factors in your portfolio.

But, just like you can't expect death-overs specialists to score runs in every match, mid- and small-cap funds need similar patience. It's a classic case of high-risk, high-reward (as can be seen in the graph below).

So, stick to one or two such funds in your portfolio - just like the Indian team does. Over-relying on them can be ultra-risky.

Supplement your core large-cap and flexi-cap funds with not more than 15-20 per cent allocation in small- and mid-cap funds.

The Versatile

Rishabh Pant and Ravindra Jadeja = ELSS (tax-saving funds) & hybrid funds

Just like Rishabh Pant is a two-in-one package, so are equity-linked savings schemes, popularly known as ELSS. These mutual funds provide double-engine benefits of growing wealth and saving taxes at the same time.

Ravindra Jadeja, meanwhile, powers the Indian team with his batting, bowling and fielding skills - much like hybrid funds, which offers you the benefits of equity, debt, cash and other such asset classes.

Getting the right strategy

Getting the combination right is half the battle won, both on a cricket field and in your investing journey.

For the remainder, it's the strategy you have in place. So, let's give them a quick glance.

Make full use of the Powerplay

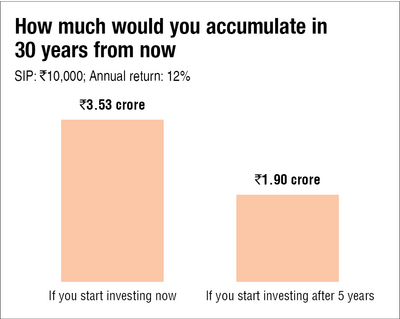

Just like batsmen take advantage of Powerplays in cricket, think of the first five years of your earning life as your powerplay.

They are going to make the biggest difference in your long investing innings.

In fact, a delay of five years can reduce your corpus by over 45 per cent!

Let's say you decide to invest Rs 10,000 every month. Assuming an annual return of 12 per cent, at the end of 30 years, you would have a corpus of Rs 3.53 crore. However, if you start five years later, you would have just Rs 1.90 crore. That's Rs 1.63 crore less - just because you started five years later!

So, start today and make use of the Powerplay.

Do not depend on just one player

While great teams have star players, cricket is still a team game. No player can win a world cup on their own. Likewise, do not depend on just one mutual fund or sector. Spread your reliance on different funds. This will help you reduce the risk element.

Keep the scoreboard moving

In tough conditions, when stroke-making is difficult, good teams look to rotate strike to keep the scoreboard ticking.

In investing, your SIPs achieve this for you. No matter how bad the markets may turn, keep your investments ticking over with your SIPs. When markets turn favourable, you would notice these were actually a blessing in disguise.

Know your risk appetite

Every cricket team plays as per the talent and personnel they have at their disposal. The Indian team is no different. They know their strengths and their weaknesses, and play accordingly.

Similarly, it is important to know what kind of an investor you are and then invest. For instance, if you are a conservative investor, you may have a higher percentage of money in relatively-safer debt funds or hybrid funds. On the other hand, if you can stomach the volatility of equity investment, you should ideally invest a higher portion of money in equity-oriented mutual funds.

In either case, we feel if you are young, it is better to take a larger exposure to equity-oriented funds. That's because the risk level reduces the longer you stay invested in them.