A common misconception among investors is that a low price-to-earnings ratio (P/E) equates to cheap valuation and, therefore, a higher margin of safety.

But is that really the case?

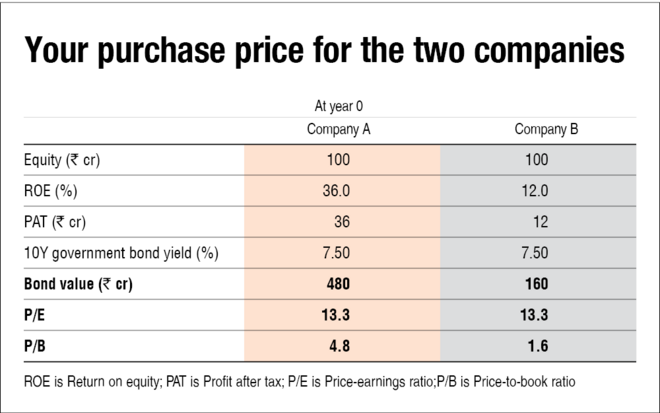

Suppose there are two companies, company A and company B, with RoEs (return-on-equity) of 36 per cent and 12 per cent, respectively. This means that if both companies have a shareholders' equity of Rs 100 crore, their profit after tax (PAT) will be Rs 36 crore and Rs 12 crore, respectively. Let's also assume that both companies reinvest all their profit back into the business to keep things simple.

You are an investor in search of acquisition and are unsure whether to invest in company A or company B. So, you take out your calculator and start crunching numbers.

First, as the return for all asset classes (stocks, bonds, real estate, artwork, etc.) is linked to the government bond yield (or the risk-free rate), you calculate the bond-equivalent value of both companies' profit after tax. This is the amount that you have to invest in a government bond to earn the same amount of profit after tax each year as that offered by the companies.

As you may know, the 10-year government bond yield is about 7.5 per cent. Based on that, you obtain a bond value of Rs 480 crore (Rs 36 crore divided by 7.5 per cent) for company A and Rs 160 crore (Rs 12 crore divided by 7.5 per cent) for company B.

Once you have the bond value, you now proceed to calculate the P/E of the two companies, which turns out to be 13.3 times (bond value divided by profit after tax) for both.

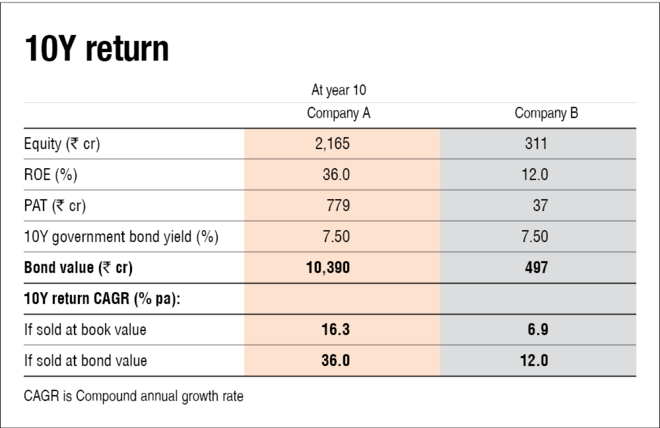

Based on the above calculation, you can easily estimate the shareholders' equity and profit after tax ten years from now. In addition, you can also find the bond value of each company at the end of the tenth year and your corresponding return from investing in them.

As seen from the table, the 10-year return for company A is far superior to that of company B, regardless of whether you sell the company at its tenth-year book value or bond value. Note that even at their tenth-year bond value, both companies have a P/E of 13.3 times.

Yes, a company with such a high RoE might not be available at such a low P/E. So, let's explore some alternative scenarios for company A.

Say instead of 13.3 times, you purchase it at a P/E of 20. Then, you would be investing a total of Rs 720 crore (Rs 36 crore x 20). Now, if you sell the company at its tenth-year bond value, your return would be a whopping 30.6 per cent per annum!

Still not convinced?

Here are some more scenarios.

Even if you buy at a P/E of 50 times, you will get a 19 per cent per annum return from company A. Yes, to make good returns from company B, you need to invest at a low P/E. However, as you can see, that is not true for company A.

To sum up

If a company with a high RoE reinvests each year's profit at that high RoE for a long period, a higher starting P/E doesn't mean a lower margin of safety. The margin of safety is embedded in the company's ability to maintain high RoEs while simultaneously maintaining a robust growth rate. In addition, the margin of safety is also dependent on your ability to identify and evaluate such companies.

Not all that glitters is gold, and not all companies with a low P/E have a high margin of safety. The consistency and longevity of RoE are equally important.

Suggested read:

Five factors to analyse a business

Six factors to consider when selling a stock