About the company

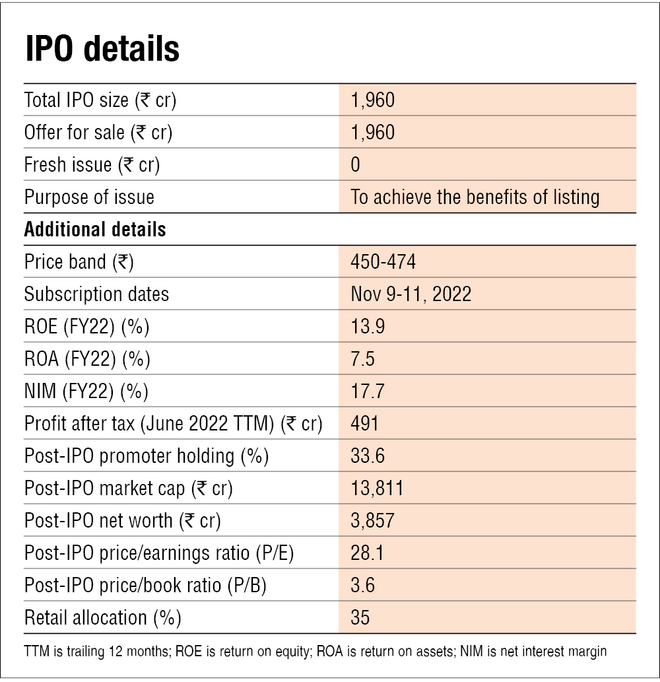

What does Five Star Business Finance do: Five Star Business Finance is a non-banking finance company that provides business loans (62 per cent of gross term loans as of June 2022) and loans for asset creation and meeting expenses such as home renovation, education, marriage, etc. (accounting for 38 per cent of gross term loans as of June 2022). The company targets customers who generate income from cash and carry businesses. These customers are mostly micro-entrepreneurs and self-employed individuals. All of its loans are secured by its borrowers' property. Headquartered in Chennai, the company's network comprises 311 branches across 150 districts (predominantly in south India).

Strengths

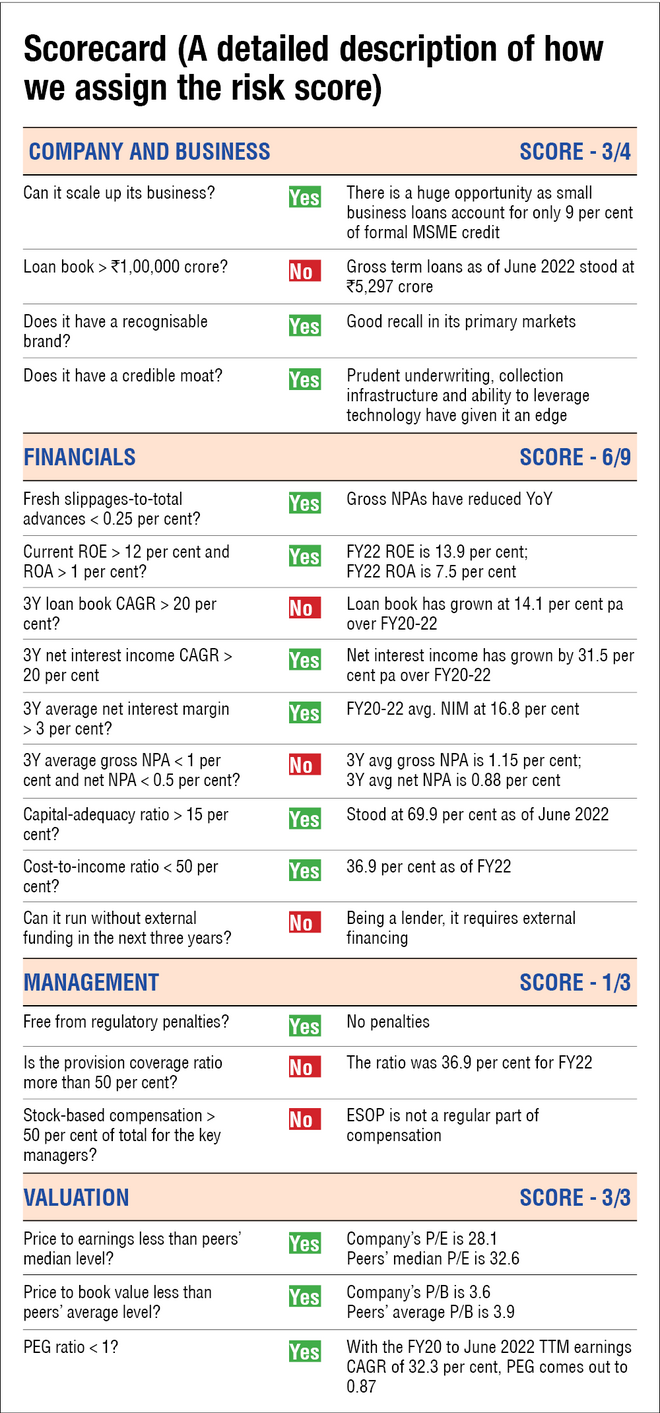

The company is one of the few institutions to have developed an underwriting model that evaluates the cash flows of small business owners and self-employed individuals (according to CRISIL). This has allowed it to keep net non-performing assets at less than 1 per cent of gross loans even after growing its loan book by more than five times in four years.

Weaknesses

As of June 2022, 30.4 per cent of the company's customers were first-time borrowers. Such customers generally have a higher risk of default.

Risk score (The lower the score, the riskier the stock)

Disclaimer: This is not a stock recommendation. Do your due diligence before investing.

Suggested read: Archean Chemical Industries IPO