About the company

What does Kaynes Technology do: It is an end-to-end and Internet of Things (IoT) solutions-enabled integrated electronics manufacturing player. It provides conceptual design, process engineering, integrated manufacturing and life-cycle support to players in the automotive, industrial, aerospace and defence, outer-space, nuclear, medical, railways, Information Technology and other segments.

Strengths

The company's wide-ranging product portfolio across multiple industry verticals limits its exposure to downturns associated with a single vertical. In addition, it also ensures consistent revenues.

- Strong supply chain and sourcing network: It possesses a mature and reliable supply chain network. Moreover, it does not rely on a single source or vendor for components. As of June 30, 2022, it has worked with over 871 vendors and procured source materials from various regions, including North America, Europe, Singapore, and locally from within India. It has an average relationship period of over 10.80 years with its top 10 suppliers.

Weaknesses

The company's top 10 customers accounted for 53.6, 46.0 and 51.0 per cent of its revenue from operations in FY20, FY21 and FY22, respectively. As it does not have firm commitment agreements with its customers, one or more such customers switching ships would severely affect its revenue and cash flows.

- Increasing competition in the electronics system design and manufacturing (ESDM) industry may create pricing and market share pressures: It operates in the ESDM sector, which is highly competitive. Large competitors with significantly higher resources may be able to offer services and solutions at lower prices and start chipping away its market share.

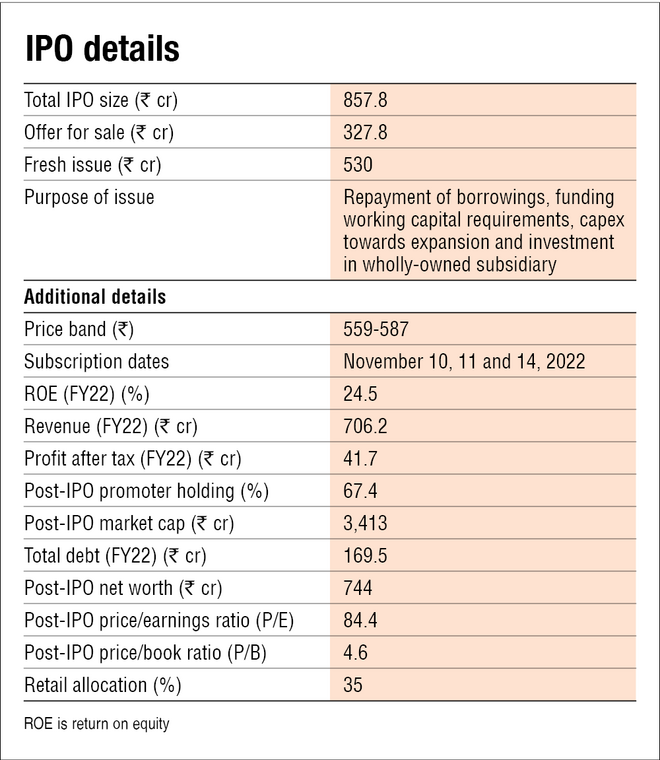

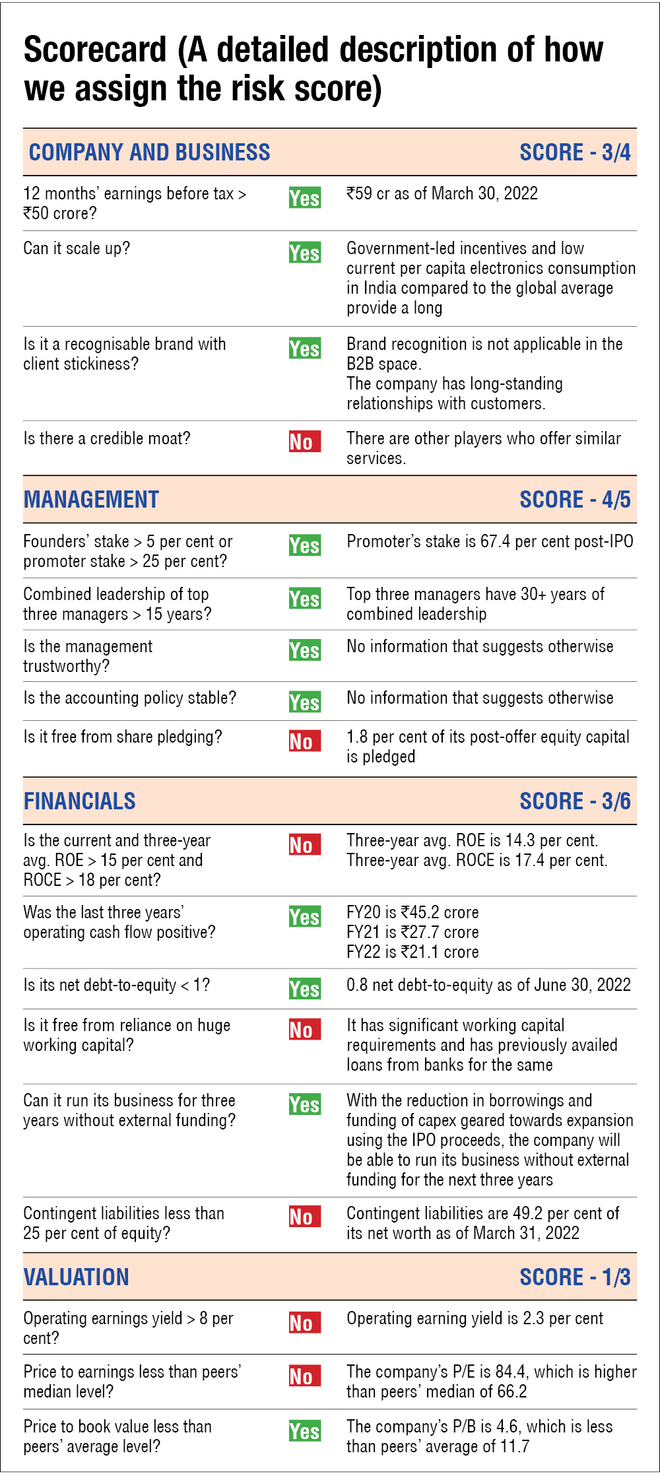

Risk score (The lower the score, the riskier the stock)

Disclaimer: This is not a stock recommendation. Do your due diligence before investing.

Suggested read: Five Star Business Finance IPO