My widowed mother lives with me. She wants to sell her immovable property having an approximate value of Rs 15 lakh to me. I am a senior citizen. Accordingly, please intimate me what will be the taxability for this amount. - Anonymous

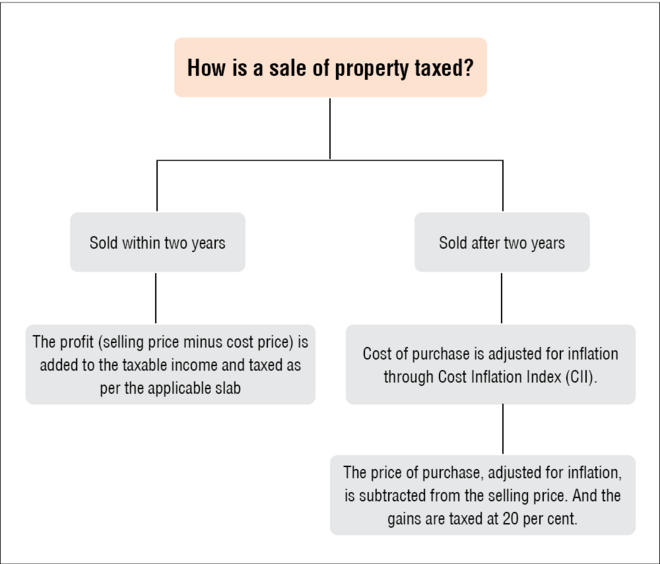

The gains on selling an immovable property, be it a residential house, building, commercial shop/office or a piece of land, are taxed as capital gains. Further, it depends on the duration for which the property has been held by the owner.

Sold within two years of purchase

If the said property is sold within two years of buying it, the entire profit (selling price minus purchasing price) is added to the owner's taxable income and taxed as per the applicable slab. One can also claim, as deduction, any brokerage that he/she may have paid for making those transactions possible.

Let's say, Mr X had bought a house one year back for Rs 50 lakh and now wants to sell it for Rs 60 lakh. He paid Rs 50,000 to a property agent for making this transaction possible. Then Rs 9.5 lakh (Rs 60 lakh minus Rs 50 lakh minus Rs 50,000) will be added to his taxable income and taxed as per the applicable slab.

Sold after two years of purchase

The treatment is almost similar when the property is sold after two years. But here, the cost of purchase is first adjusted for inflation using an index provided by the income tax department. And instead of adding the gains to the taxable income, they are taxed at a flat rate of 20 per cent. The process of adjusting the cost for inflation is called 'indexation' and it eventually helps lower the tax burden. Because the cost of purchase increases in tandem with inflation, the profit gets reduced. The owner can further claim other deductions that are available under the provisions of the Income Tax Act.

To calculate the indexed cost of purchase, the cost inflation index (CII) for the year in which the asset is transferred or sold is divided by CII for the year in which the asset was acquired or bought.

Calculation of tax liability: In the above example, the year in which the asset is transferred or sold is 2022-23 and the cost inflation index (CII) for 2022-23 = 331. The year in which the asset is acquired or bought is 2018-2019 and the CII for 2018-2019 = 280. So the CII = 331/280 = 1.18. It is then multiplied by the cost of purchase. In the given case, the indexed cost of purchase would be Rs 59.11 lakh (Rs 50 lakh multiplied by 1.18). The taxable gains would be only Rs 39,000 (Rs 60 lakh minus Rs 59.11 lakh minus Rs 50,000). At a flat rate of 20 per cent, the tax liability would be Rs 7,800 (20 per cent of 39,000).

Cost of inflation index is released by the income tax department for every financial year and can be accessed by visiting this link here.

Conclusion

So, depending on whether you're selling your house within or after two years of purchase, you can calculate your tax liability using the method described above. Additionally, the income tax department allows certain deductions, but that is a topic of discussion for some other time.