Balanced advantage funds (BAFs), also known as dynamic asset allocation funds (DAAFs), have attracted a large number of investors of late.

With a rapidly rising asset under management (AUM) over the last two years, balanced advantage funds have moved swiftly from tenth to fifth position across all 37 SEBI-defined mutual fund categories. If we look at hybrid funds only, BAFs currently sit at the top in terms of the amount of money managed.

In this story, we will focus on how the gains made from balanced advantage funds are taxed. But let's first understand in brief what exactly these funds are.

What are balanced advantage funds (BAFs)?

BAFs invest in a mix of equity and debt and dynamically manage allocation between the two, which is usually driven by a rule-based model developed by the fund house. They do not have any restriction on the minimum or maximum allocation to equity or debt.

The objective of such funds is to capture the potential upside during bullish market phases and limit the downside when equity markets are volatile.

You may check out our earlier coverage on balanced advantage funds and what drives their popularity.

Tax treatment of balanced advantage funds

To determine the tax liability on any mutual fund gains, you need to know two things:

- The type of fund: From the taxation point of view, mutual funds can either be equity-oriented or non-equity-oriented. Equity-oriented funds are those that invest at least 65 per cent of the corpus in equities.

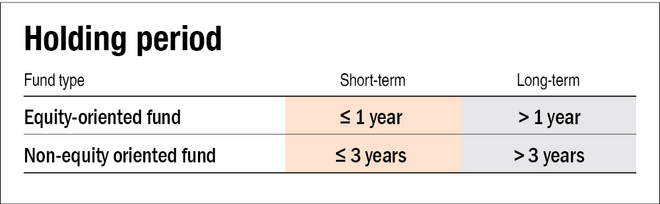

- Holding period: Your mutual fund holding period can either be short-term or long-term. The duration to define this is different for equity-oriented mutual funds and non-equity mutual funds, as explained in the table below:

While this classification between the two is quite straightforward for most mutual funds, it's not the case with BAFs as they are dynamic in their asset allocation. So, if a BAF has maintained more than 65 per cent allocation to equities, then it would be an equity-oriented fund, else a non-equity oriented fund.

Most BAFs maintain a gross equity of more than 65 per cent (i.e., without netting the hedged positions) to give tax advantage.

Determining tax liability

Once you know the above two information about your fund, you can evaluate your tax liability as follows:

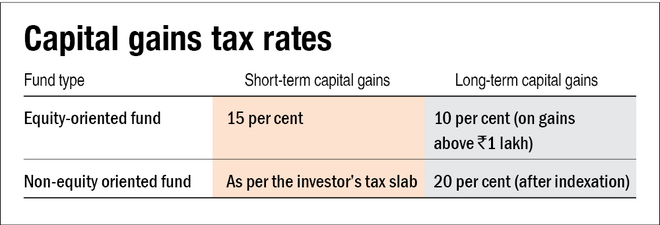

- In the case of an equity-oriented fund: If your holding period is more than a year, the gains are termed as long-term capital gains. In this case, gains up to Rs 1 lakh in a financial year are tax-free, but anything above that is subject to a 10 per cent tax.

- In the case of a non-equity oriented fund: If your holding period is less than three years, the gains are termed as short-term capital gains and are added to your income. This is taxed as per your income tax slab rate.

If your holding period is less than a year, the gains are termed as short-term capital gains and are taxed at 15 per cent.

If your holding period is longer than three years, then the gains are termed as long-term capital gains and are taxable at 20 per cent after indexation.

Suggested read: Balanced advantage funds: A case of 'pinky' promise or 'pompous' promise