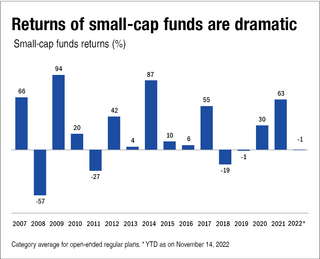

Anyone with the slightest knowledge of investing would know how rewarding small-caps can be. Look at the historical calendar year returns. In the year 2009, an average small-cap fund returned a whopping 94 per cent. But that wasn't the only year when small-caps gave spectacular returns. The years 2007, 2014, 2017 and 2021 also witnessed the same.

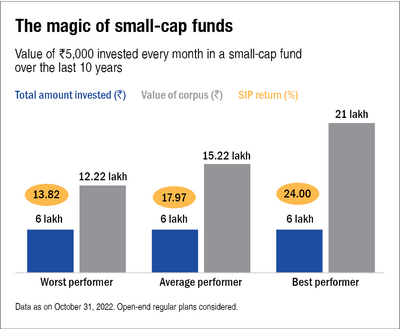

In fact, if you look at the 10-year SIP returns of the worst-performing small-cap mutual fund, it comes close to 14 per cent (as on October 31, 2022). This means if you had started an SIP of Rs 5,000 a decade back in the worst-performing small-cap fund, your Rs 6 lakh investment would have become Rs 12.22 lakh now. That is more than double!

And if you were lucky enough to have invested in the top-performing fund, your money would have grown to Rs 21 lakh. That's 3.5 times more!

This charm of getting extraordinary returns is what lures people towards small-caps.

But...

Small-caps can be very volatile

Small-caps can fall sharply. For instance, look at the year 2008. An average small-cap fund had fallen by 57 per cent. This means that if someone invested Rs 1 lakh at the beginning of 2008, they'd end the year with just Rs 43,000, eroding more than half of their money.

Such falls can be very disheartening.

But that's their nature. Their rise and fall are dramatic, as shown in the graph below.

How to survive the volatility

One, have a long-term investment horizon.

The longer you stay invested, the lesser is the chance of losing your money.

As we showed you earlier, the worst-performing small-cap fund grew 14 per cent over 10 years - much higher than fixed deposits and gold put together!

Two, don't allocate more than 15-20 per cent of your money to small-caps.

Three, invest through SIPs. And when you want to withdraw, choose the SWP.

Why you should choose small-cap mutual fund

Quality small-cap stocks have a much higher return potential. The right small-cap stock can multiply your money by 100 times, or probably much more.

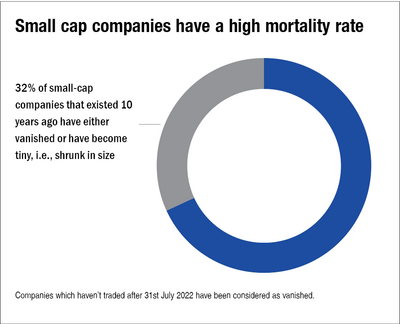

However, small-cap stocks have a very high mortality rate. Of the 2,500 small-cap stocks that existed 10 years back, more than 800 of them have either vanished or shrunk in size. This means you can actually lose your money if you land up with such a stock.

Additionally, it is not easy to choose the right small-cap stock. The universe of small-caps has more than 3,800 stocks and selecting the right one takes a lot of patience and research. And since these companies are so small, you may not get all the information you need to form an opinion on them.

This is where small-cap mutual funds can be immensely useful to you.

These funds are managed by professionals who have experience in stock-picking. Moreover, they have more resources at hand. Just like you'd choose a lawyer to look after your legal matters, it makes sense to seek a fund manager's expertise to help you build wealth.

Just to illustrate the professional skills of fund managers, we saw that of the 800 small-cap stocks that vanished or shrunk in the last 10 years, around 80 per cent of them were successfully avoided by them. At least, they were not there since 2002.

The other benefit of mutual funds is diversification.

Usually, small-cap funds invest in around 50 to 70 stocks. So, even if one of the stocks goes sour, you don't lose your shirt.

What to look at when choosing a small-cap fund

Picking the right small-cap stock requires more experience and skills. That is why you should look for a scheme which has a fund manager with a credible track record and experience.

Keep these three factors in mind and let the power of small-caps help your wealth grow.

Happy investing!

Suggested watch: How does a huge AUM affect the performance of a small-cap fund?